I did a short webinar yesterday, during which I got a lot of questions about three specific charts I’ve been watching.

Two of these stocks are very familiar to me, while the other is one I traded recently (with mixed results).

Today, I wanna dive into further detail on a few key points that some of you have asked about recently, including…

- What happened with my failed trade yesterday

- Why you should never chase alerts

- How I’m playing crypto at these levels

- The one sector I can’t take my eyes off of right now

Here are the three charts I’m getting the most questions about this week…

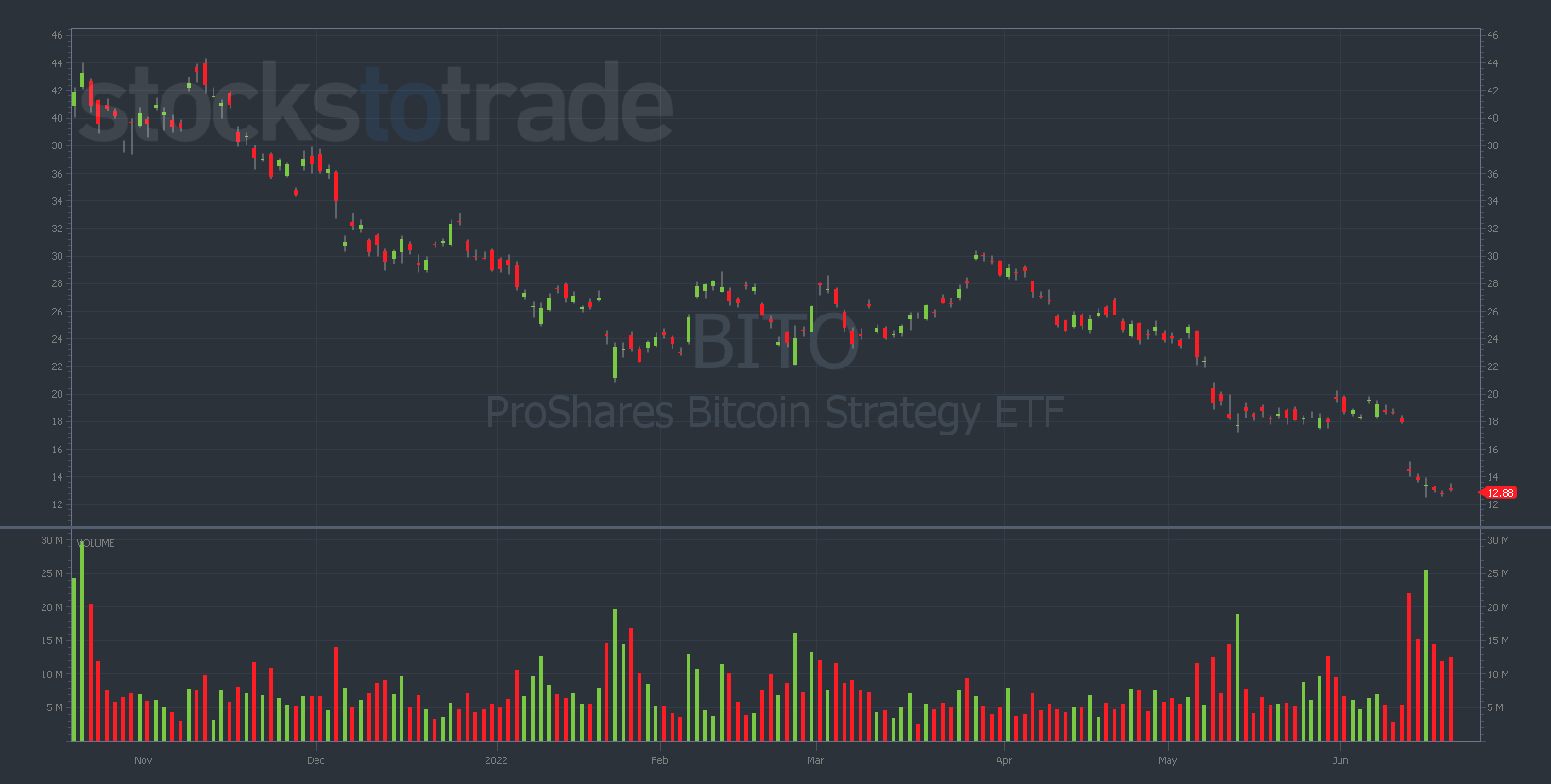

ProShares Bitcoin Strategy ETF (NYSEARCA: BITO)

After bagging my biggest trade ever on this fund last week, I’m unsurprisingly getting a lot of questions about BTC and BITO.

In my view, there isn’t great risk/reward on either side of this trade right now.

The downside has been brutal over a very short period.

If you haven’t already taken advantage, I wouldn’t chase a short position.

On the other hand, averaging down long on crypto here might be an even worse strategy.

I wouldn’t be buying any calls on any crypto-related plays or attempting to average down a BTC position.

If you are, cut your losses and move on.

I think there will be excellent opportunities to trade crypto soon, but we need to be patient for now.

Walt Disney Co. (NYSE: DIS)

I made somewhat of a regrettable trade on Tuesday as I broke my own rules and attempted to call the bottom by buying calls on a rapidly-declining DIS chart.

In this case, I saw some oversold technicals and tried to feel the near-term bottom out. Unfortunately, DIS is unstoppably bearish right now and my timing was off.

The entire market was bouncing on Tuesday, making it even more notable that DIS could never stage an intraday rally (aside from a very brief early-morning pop).

I thought DIS would try to make some kind of move, but it never did. Take it from me … pass on this one for now.

I also need to take this opportunity to once again remind everyone to NEVER chase my trade alerts! I saw a lot of people trying to chase this DIS trade. This was a speculative play, not to be chased!

ALWAYS do your own due diligence. Enter a setup because it makes sense for YOU, not because I (or anyone else) traded it.

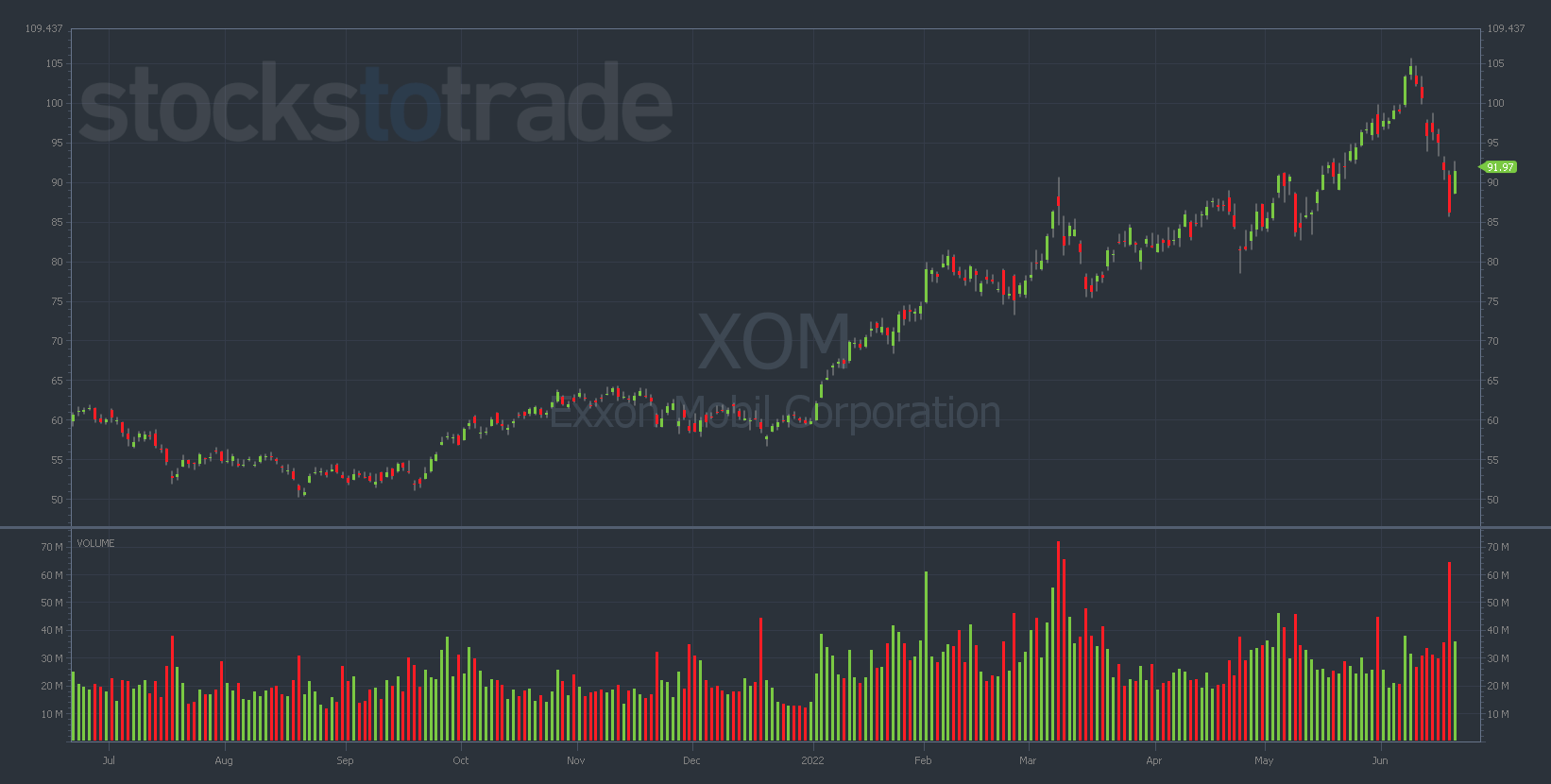

Exxon Mobil Corp. (NYSE: XOM)

I can’t stop looking at oil charts — XOM in particular.

As some of you may remember, I perfectly called the top on the energy sector back in March.

And now, I’m starting to see many of the same topping signals that I was seeing around that time.

Is this a guarantee that oil stocks are about to crash? Of course not.

This sector is already significantly off its highs and I may have missed the bulk of the move already.

Additionally, there’s talk about the possibility of a ‘gas tax holiday’ or action related to the Keystone Pipeline. And I don’t love the uncertainty around these unknowns.

This is a news-driven setup, so you must be paying attention to the headlines if you plan to trade oil stocks.

But I think I’ve proven that I have a spidey sense for momentum charts that are about to crack … and I’m getting those feelings looking at XOM.

Let’s break down just a few of the bearish indicators:

- Rising price and falling volume on the daily chart

- Nearing a perfect retracement from the pandemic lows to the previous highs

- The first red week finally happened

Keep an eye on oil stocks this week (and next). I’d love to see a bounce I can buy puts into.

I think we’re getting close to a potentially great trade opportunity in this sector, just not quite there yet.

Final Thoughts

Those are my thoughts on the charts I’ve been watching closely. When it comes to the rest of the market, it’s anyone’s guess at this point…

Based on the early price action, this week could bring a significant bear-market bounce if it keeps heading in this direction.

That’s why I bought calls on DIS, it just didn’t work out. That said, I’ll probably be even more cautious around trading puts this week.

The market’s been leaning towards the oversold side for a while now, and this week it’s feeling pretty bouncy to the upside.