I’ve made some AMAZING trades and terrible ones over the last 10 years…

You’ll never nail them all. So you must be real and embrace that losses are part of the game.

This isn’t what you want to hear, but it’s the truth … You’re gonna make some bad trades in your (hopefully long) trading career.

Avoiding bad trades is impossible. The important thing is that you pull valuable lessons from your disappointing plays.

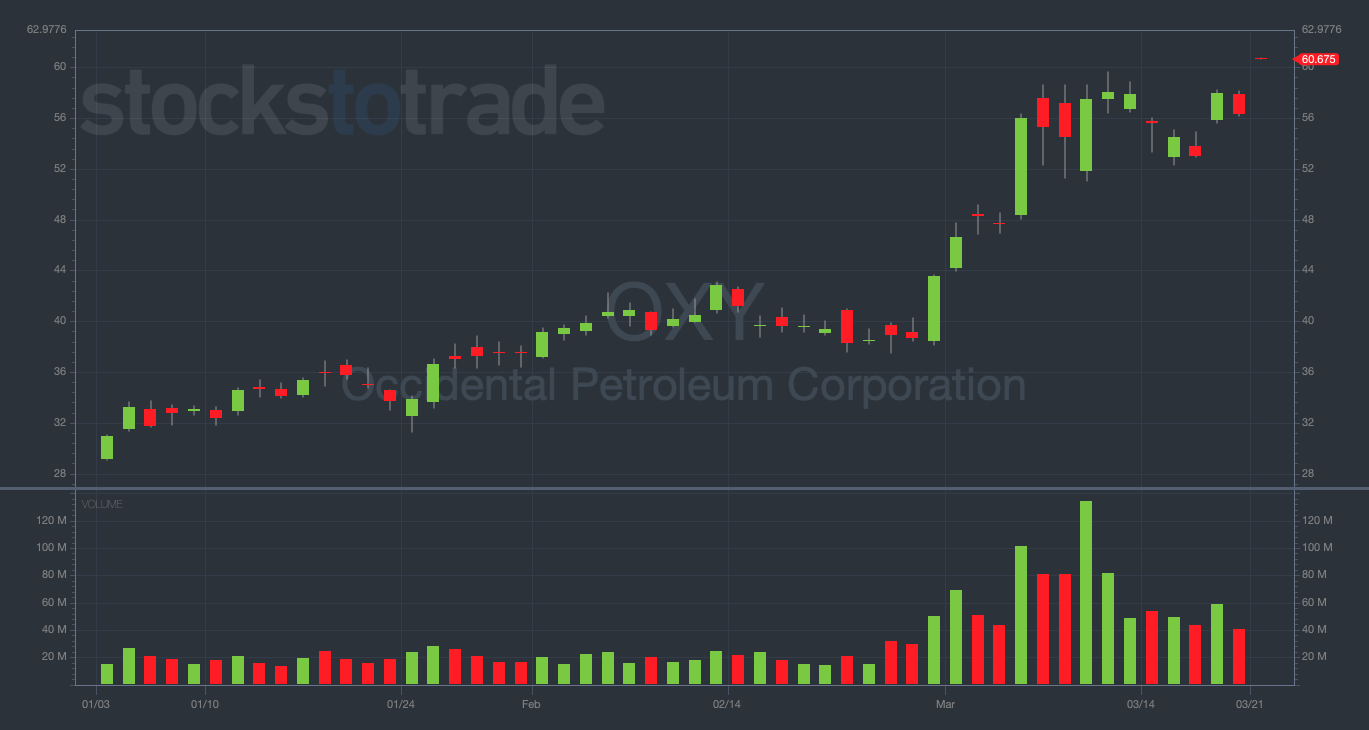

This idea is at the front of my mind as I reflect on my regrettable Occidental Petroleum Corp. (NYSE: OXY) trade from last week. See the daily chart below…

I chased the downside on an already beaten-down sector. In doing so, I inadvertently went head to head with a stock market legend.

But worst of all, I executed a poor trade that was completely avoidable. I took a $20,000+ loss…

Instead of beating myself up about it, I’d like to make sure YOU don’t face the same fate.

With that in mind, let’s break down the three critical lessons I learned from my OXY trade…

Lesson #1: Don’t Fight the Market

OXY is a play that is HEAVILY accumulated by none other than Warren Buffett.

It’s also in a hot sector that’s been surging lately — oil stocks. And by now, you should all know what happens to sectors that surge out of control…

You guessed it: they CRASH.

Unsurprisingly, oil stocks started reversing at the beginning of last week.

And the OXY chart stood out to me as one that hadn’t yet seen a big reversal to the downside.

But the trade turned out to be a disaster. I didn’t respect the chart or the news.

Bottom line: I was late to the puts party. The big dips had already been taken out of the energy sector.

Additionally, the fact that OXY didn’t see a big crash while the rest of the energy sector was getting pummeled should’ve been a clear signal to steer clear of puts.

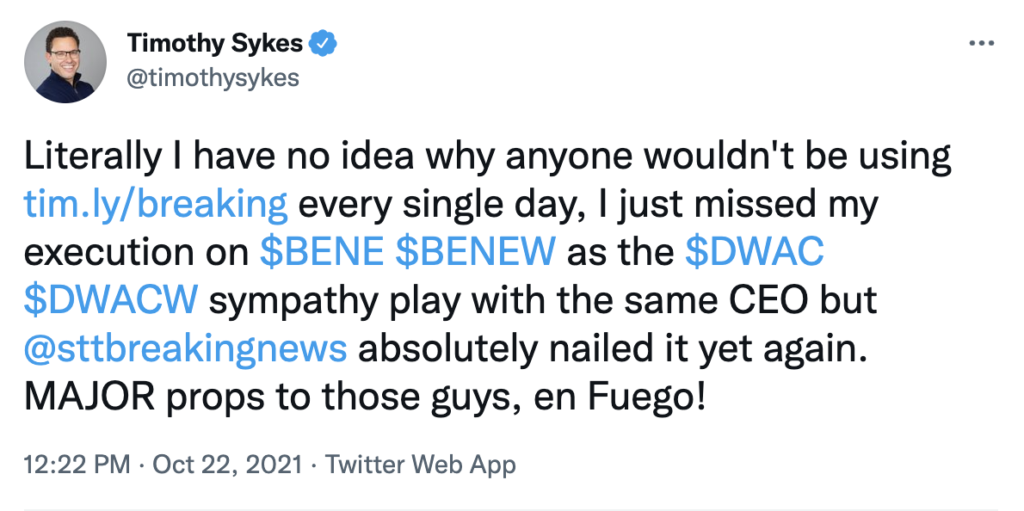

Are You Missing Out On Epic Trades?

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

Tim Sykes encourages his students to use Breaking News Chat every day:

By the time I bought OXY puts, I was chasing the downside in oil stocks after it had already occurred. Plus, I chased it on the wrong oil stock.

My advice? Don’t battle Warren Buffett.

Lesson #2: Control Your Emotions

Emotions are a trader’s worst enemy.

I’m usually incredibly measured and disciplined with my emotions. But on the OXY trade, I allowed my human nature to get the best of me.

First, some background information…

Last week, I traded Chevron Corp. (NYSE: CVX) puts. And I was incredibly unsatisfied with this trade, to say the least.

These lingering emotions affected my mindset heading into the OXY trade.

Both stocks live in the same sector, and I knew I’d missed the juicy downside on oil stocks so far…

When I scanned all of the oil stocks in the market, the OXY chart stood out because it hadn’t tanked like the rest of the energy sector had already.

I knew this was due to Buffett’s accumulation, but I underestimated the power of the ‘Oracle of Omaha’ buying the stock.

I’ve seen it before: A famous investor buys a stock, then retail traders try to follow them in for a quick swing.

These unsuspecting newbies usually get destroyed by market makers, who are waiting like sharks for inexperienced amateurs to rabidly buy the popular calls.

Lesson #3: Manage Your Risk

Last week, I mentioned that I don’t like to risk more than 1% of my account on any given trade.

I stuck to this rule on my OXY trade. While I lost about $20,000 — I was disciplined about not losing any more than that.

I can deal with losing $20,000, but I know that many of my students can’t afford to take losses this big.

This is why I stress using percent terms to think about your risk management, as opposed to dollar amounts.

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

A 1% risk can be hugely different in actual dollar amounts depending on your overall account size.

WARNING: If you don’t manage your risk CAREFULLY, you won’t stay in the trading game long.

Learn from my mistake … NEVER get overly aggressive on a play that’s accumulated by legendary traders (especially if that trader is Warren Buffett)!

And finally — you MUST be willing to switch direction on a trade when the price action calls for it!

Now that I’ve seen the relative strength of OXY in the energy sector, I’m flipping to buying calls. (But more on that later this week.)

Final Thoughts

As I mentioned before, bad trades are unavoidable. Even the greatest traders in the world will occasionally take on a subpar setup.

But what separates these stellar traders from the 90% who FAIL is their ability to identify their mistakes — and avoid them moving forward.

Next time you make a disappointing trade, challenge yourself to pull some valuable lessons from the mistake. You’ll become a better trader for it.