Happy Friday, Evolvers!

Today, the consumer price index (CPI) — a key inflation metric — came in showing an 8.6% rise in May (its highest level since 1986).

This is an incredibly negative internal reading for the U.S. economy, and the bearish price action is already showing that. I expect more to come.

Bottom line: Be very careful trading today. The price action is almost guaranteed to be extra volatile.

But enough about macroeconomics. Let’s have some fun. It’s Friday, so that means it’s time for some Q&A.

Evolvers asked some great questions during Thursday’s webinar. A few of them really got me thinking.

Now, let’s answer them…

“If you had to pick one, what’s your favorite setup right now?”

Well, since I missed an excellent short opportunity on Alibaba Group Holding Ltd (NYSE: BABA) … my next favorite setup would have to be a potential short opportunity brewing in the energy sector, specifically the United States Oil ETF (NYSE: USO).

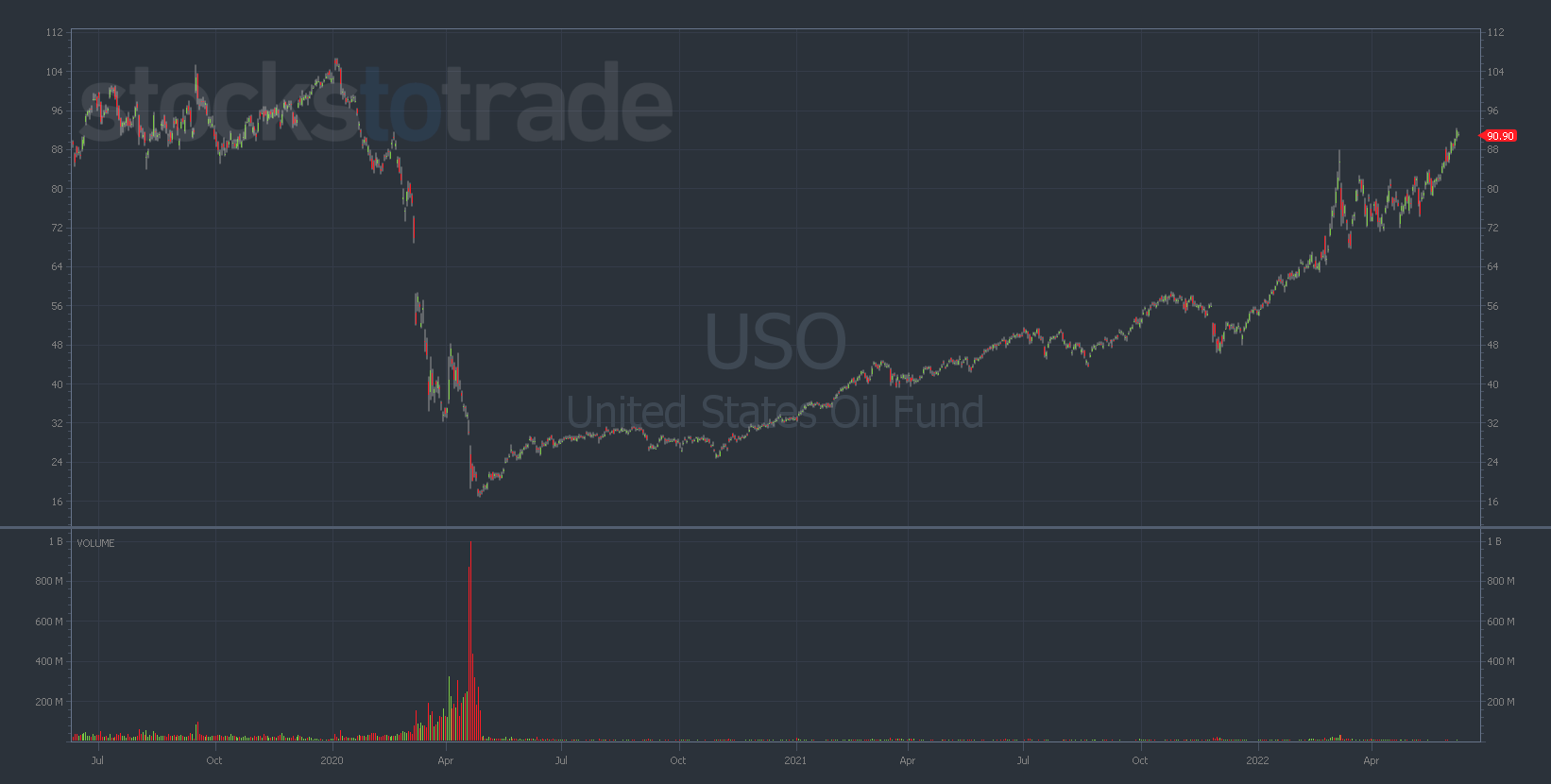

Let’s look at a long-term daily chart for USO…

I would love for USO to push back up to the $105-$110 range. As you can see, it traded in this area back in 2020, just before the pandemic crash.

A 2-year, 480%+ gap fill would be pretty poetic and open up a clear put-buying opportunity.

Other than that key price range, I’m waiting for USO to make a higher-volume green day. The volume’s been pretty low since the massive blow-off top in oil stocks that I predicted back in March.

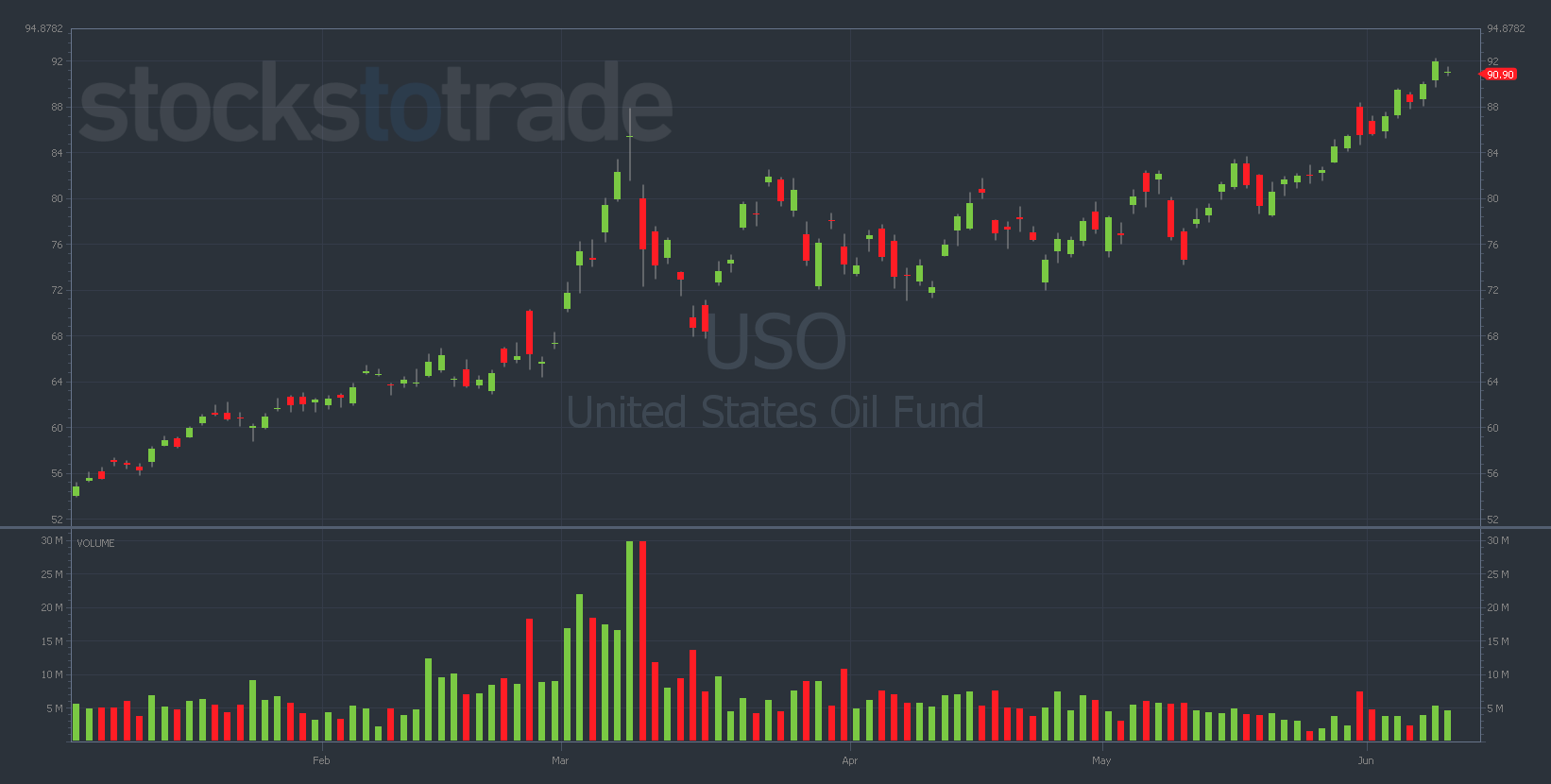

Ideally, I’d like to buy puts on a day like March 8. Notice that USO traded just under 30 million shares that day, while it’s currently averaging about 5 million per day.

Let’s look at a YTD chart to see that better…

Bottom line: We wanna see the volume and price ramp simultaneously into a big crescendo.

Watch for the $105-$110 range and any day where USO trades over 10 million shares.

“What ‘type’ of trader are you?”

First, I have a negative bias. I like buying puts more than calls. Catching the downside of charts has always been easier for me than catching the upside.

Beyond that, I think of myself as a technical trader. What do I mean by this?

Specific technical indicators in chart patterns give me the conviction to execute my trades.

Volume, price action, trendlines, and key levels usually dictate the moves I make in the market.

I look at charts and trust the patterns. I learned the finer points of technical analysis from my mentor Tim Sykes.

And if you really wanna learn to trade, you should take lessons from a master (like I did). Check out Sykes’ Trading Challenge, where I was shown the skills that made me a multi-millionaire.

Lastly, I’m a cautious and patient trader. I’m not a gunslinger. I swing for singles as opposed to home runs.

This guarantees that my account never has a huge drawdown and allows me to sleep well at night.

Final Thoughts

I’m hoping for a positive surprise in the inflation numbers, but I’m preparing for the worst. I suggest you all do the same.

Either way, the volatility presented could lead to some juicy setups next week. Stay tuned.

Have a great weekend, everyone!

Watch This BEFORE 9:30AM!

Have you seen what Tim Bohen has been up to EVERY morning between 9:29 and 9:30am?

If not, click here now because he’s getting ready to do it again.

Do NOT wait to see this.