Happy Friday, Evolvers!

Volatility has been ramping this week, with the Volatility Index (VIX) up 17%+ in the past five days…

This has led to a boatload of trashy stocks raging to the upside, attempting to create gamma squeezes similar to Carvana Inc. (NYSE: CVNA)…

On Thursday, beaten-down ‘meme stocks’ like Upwork Inc. (NASDAQ: UPWK), Fastly Inc. (NASDAQ: FSLY), Wayfair Inc. (NYSE: W), Fiverr International Ltd. (NYSE: FVRR), Nikola Corporation (NASDAQ: NKLA) and Ride Aid Corp. (NYSE: RAD) were all up double-digits.

Why do I bring this up? Because you must know the market you’re trading…

When volatility is this elevated, with such large price swings occurring … amazing trading opportunities can be waiting in the wind.

In fact, I entered a potentially juicy trade yesterday (but more on that later)…

But now, it’s time for our Friday Q&A. Keep reading and I’ll answer your questions…

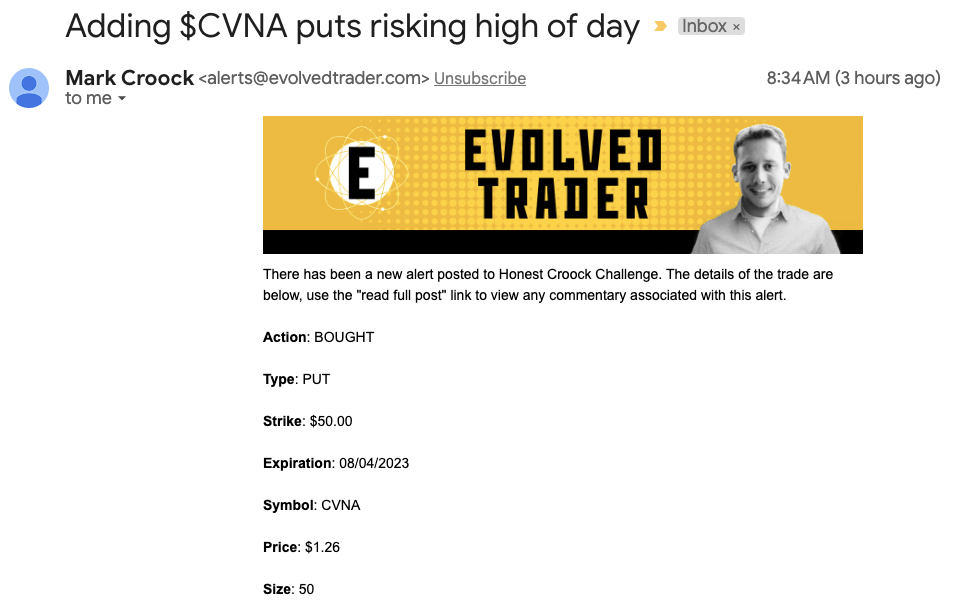

“What was your thesis behind buying CVNA puts on Thursday? Why did you choose to buy the contracts when you did?”

As everyone knows, I’ve been tracking CVNA very closely.

That’s because CVNA is, without a doubt, the wildest stock in the market right now…

After reaching a ridiculous high of $360 in August 2021, the stock shed 95% of its value, trading as low as $4.41 this January.

But in May, short-squeeze fanatic meme stock traders decided it was time to rally CVNA out of oblivion.

The stock has since surged 250%+ into the $50s, and I first scalped it on the long side.

Last week, I bought calls on CVNA, turning a $12,620.98 bet into $87,978.06 for a gain of 598% and a total profit of $75,400!

But as I’ve mentioned before, the ideal way to profit off of a stock as crazy as CVNA is to play both sides of the chart.

So, now that I’m seeing certain topping signals in the CVNA chart, I’m betting that a big dump could happen in the next day or two.

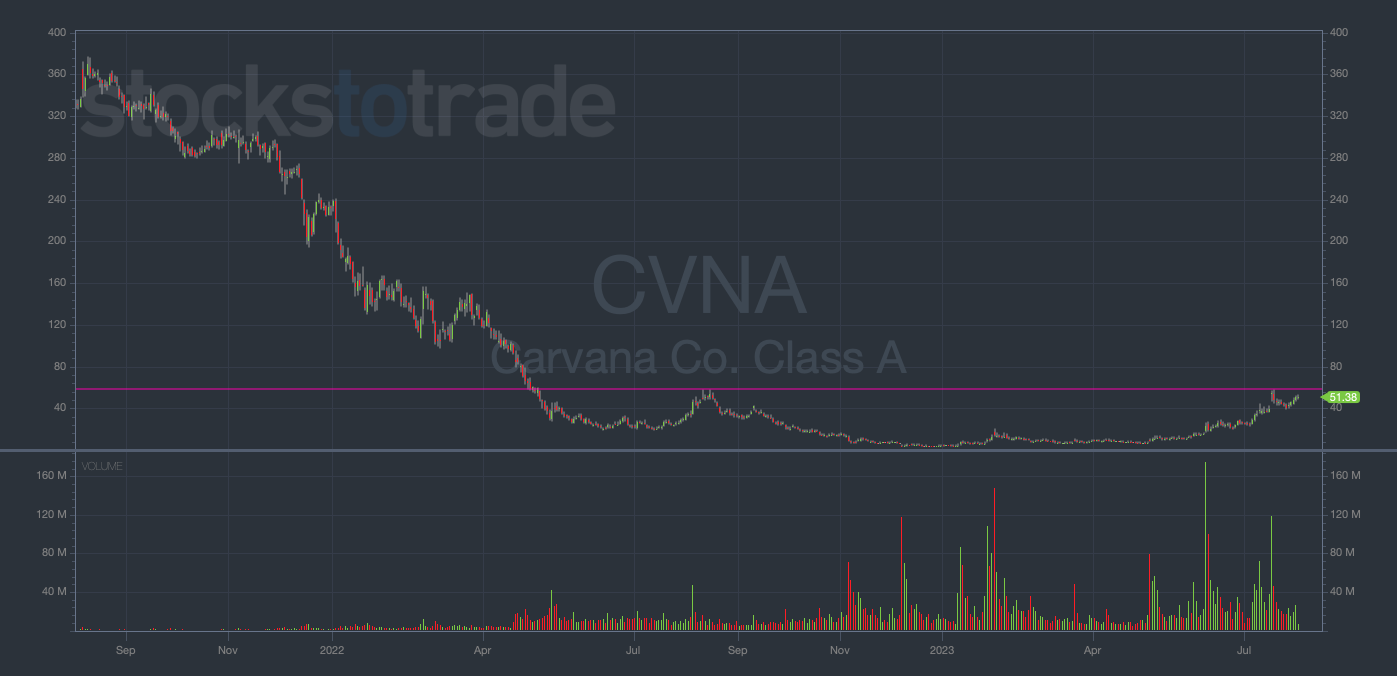

Take a look at the 2-year daily chart…

CVNA 2-year daily chart — courtesy of StocksToTrade.com

Notice how last year, in mid-August 2022, CVNA hit a brick wall in the high $50s … then crashed enormously.

This is a textbook example of a historical resistance level — a price level that a stock has had difficulty exceeding in the past.

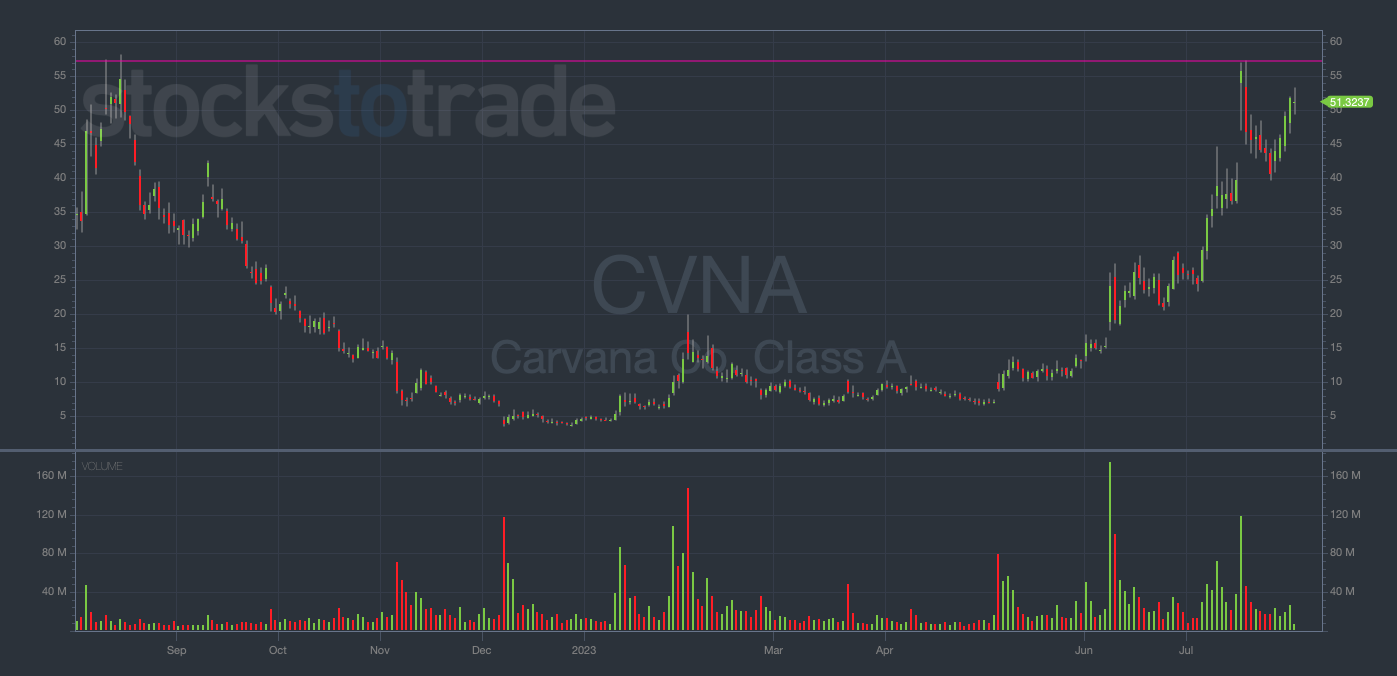

Now, let’s zoom into the 1-year chart…

CVNA 1-year daily chart — courtesy of StocksToTrade.com

Again, take note of how close the chart is to the long-term resistance level at $58.

So, to answer your question, my trade thesis is this…

I’m combining this unignorable technical indicator with my gut feeling that the CVNA party is almost over…

As mentioned in my alert, my risk level is the HOD at $53.31.

My plan is to stay patient and keep these puts overnight as long as CVNA holds red on the day.

“What’s the single biggest mistake you see students making?”

It’s hard to zero in on a single answer to this question as there are so many different aspects to trading.

Plus, every trader is unique. We all have specific areas that need improvement.

So I’m gonna cheat a little bit on this one and write a short list…

Mistake #1: Marrying a Position

This one’s simple. Cut your losing trades immediately. There’s a reason this is Tim Sykes’ #1 rule.

Take it to heart, put it into action, and you’ll be a better trader for it…

However, so many traders get married to their positions, convictions, or even to a specific stock. Then, if any one of those things goes against them, they get smoked.

So, don’t get attached to any one trade and cut your losses immediately.

Additionally, take profits quickly. This is especially critical for small accounts!

Mistake #2: Chasing Alerts

Some ‘traders’ think they can simply copy another person’s moves in the market to great success. But this is a total fallacy…

If you rely on chasing alerts, you’ll never develop a consistently winning strategy that works for you.

Focus on finding trades that fit your strategy, don’t blindly follow other traders.

Mistake #3: No Entry/Exit Plan

I see some traders get into a position without a clear idea of how they’ll get out. But this is a recipe for disaster.

You need to have a solid game plan for any possible scenario the market may throw at you.

What will you do if your contracts open up 100% the following day? What if they’re down 50%?

These are the questions you should be asking yourself BEFORE you enter any trade.

Final Thoughts

Have a great weekend, Evolvers!

Next week, I’ll break down some more recent trades that hold some valuable lessons within them.

But for now, study hard and I’ll talk to you all on Monday!