Happy Friday, Evolvers!

The market continued to slide further this week. Not surprising to me at all.

We’re starting to see fear overcome greed, at least in the short term, as traders digest the fact that interest rates aren’t going lower anytime soon.

That said, my strategy remains the same: I’m looking to trade volatile momentum stocks (more on that later)…

This brings me to an important point…

No matter what the market is doing, you have to trade the strategy that works for you.

Don’t force yourself into unfamiliar positions just because the overall market is shifting.

And if the current price action doesn’t work with that strategy, sit on the sidelines until your ideal setups present themselves.

Now, it’s time for our Friday Q&A. Keep reading to see my answers to your questions…

“Do you ever trade options on the major indexes (SPY, QQQ, DIA)?”

While it’s not a major part of my strategy, I definitely have traded options on these funds in the past…

Notice when I made two of these trades: In February 2022, when the stock market was beginning an infamous downtrend.

2022 turned out to be the worst year for the major indexes since 2008, which is why I was watching the major indexes so closely at the time.

Now, let’s fast forward to today…

While this situation is completely different, stocks are currently facing headwinds following the FOMC meeting.

(The SPDR S&P 500 ETF Trust (NYSEARCA: SPY) recently dumped 4% in five trading days…)

In this catalyst-driven environment, where the entire market is on pins and needles, I may dabble in trading these indexes sometime in the near future.

That said, trading the major indexes isn’t my bread and butter.

I’d rather trade more volatile names while using the index charts as a gauge of overall market sentiment.

But aside from the major indexes, there’s another group of names that can be valuable, big-picture trading opportunities — commodities.

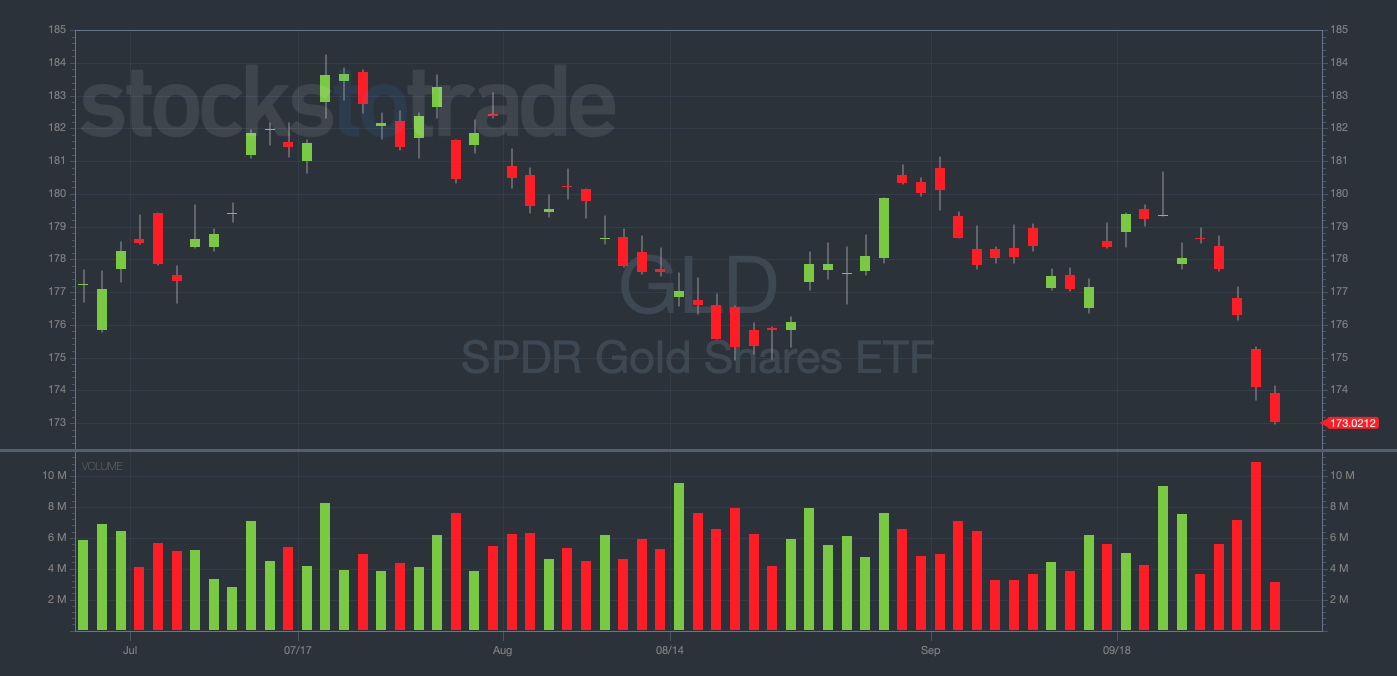

Yesterday, I bought 200 10/6/23 $175 Calls on a certain commodity fund — the SPDR Gold Trust (NYSEARCA: GLD).

I think GLD could be setting up for a first green day as the fund is incredibly oversold…

GLD 3-month daily chart — courtesy of StocksToTrade.com

Plus, the fact that stocks were up while the U.S. dollar was down on Thursday leads me to believe GLD could catch up to this move rather immediately. (GLD and the dollar tend to trade opposite of one another.)

This isn’t exactly a major index trade, but it’s closely related to the moves in the overall market.

“How did you first get into trading options?”

Back in my first few years of trading, I noticed a lot of IPO stocks would get overextended while having lock-up agreement dates (when insiders in the company could start selling their shares).

These stocks would sell off 10%–20% over a few weeks as they got closer to the lock-up date … a predictable catalyst.

That’s when I started experimenting with put options to make money when these stocks would go down.

I realized that, by trading options, I could get more leverage in my trades while simultaneously risking less money … a win-win.

I saw the potential to bag 100-300% gains very quickly if the stock moved in the right direction. I had never seen that before with trading stocks.

In the beginning, I took small positions to grow my account using this options-trading strategy. I was able to take advantage of the volatility without tying up too much capital, all thanks to options.

Even better, options allowed me to expand beyond penny stocks…

Beforehand, I thought I could never get the gains I was looking for trading large caps. But once I realized the power of options trading, a whole new world of tickers opened up to me.

When I started trading large caps with my new options strategy, a light bulb went off.

I finally grasped that if stocks were in a hot sector, I could potentially play puts and calls on both sides of the chart.

I made about $150,000 in six months, but it took me about two years to start earning enough money to cover all of my life expenses. I haven’t looked back since.

Take it from me…

I’m a living example of how “slow and steady” can win the race.

Fast forward to today and I’ve earned more than $4 million trading stocks and options.

So, any time you feel discouraged, just remember this: Your trading journey is a marathon, not a sprint.

And speaking of your trading journey…

Are You Ready To Take The Next Step?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!