Happy Friday, Evolvers!

As I mentioned yesterday, the market is extremely choppy right now, making it difficult to find reliable setups.

One minute the market looks bullish, then moments later it looks extremely bearish.

I considered buying Amazon.com, Inc. (NASDAQ: AMZN) calls this morning. The stock is down five days in a row, trading at its lowest level since March 2020.

So when the market initially ripped at the open, I thought AMZN could be a good dip-buy opportunity.

But I quickly changed my mind after seeing the tumultuous green-to-red price action on the S&P 500 ETF Trust (NYSEARCA: SPY).

Make no mistake … this ‘chopfest’ is happening because of the monthly jobs report, which came in hotter than expected this morning with non-farm payroll openings growing by 260,000 vs. a 200,000 estimate.

Additionally, I think the insane options volume on the SPY is influencing the price action. Options traders and market makers are battling over a handful of critical strike prices as millions of dollars in premium is set to expire today.

That said, now is not the time to get FOMO. I remain on the sidelines for now, and I suggest Evolvers do the same.

But for now, it’s time to get to our Friday Q&A! Keep reading to see my answers…

“What do you do (and what should I do) to prepare outside of active trading hours?”

This is a great question because how you study is just as important as how you trade.

The first thing I focus on is preparing my weekly watchlist. Building this list is an essential part of my trading strategy.

I’m not a long-term investor or a hold-and-hoper. I don’t even own any stocks.

I’m an options trader. My opportunities to profit exist week-to-week, hour-to-hour … sometimes even minute-to-minute.

So it should go without saying that I need to have a clear and concise list of potentially tradeable stocks at the top of every week.

You should as well.

Aside from building my watchlist, I like to take time outside of active trading to analyze charts.

I see myself as a technical trader. In other words, it’s my technical analysis of chart patterns and setups that gives me the conviction to execute trades.

But during market hours, it can be difficult to accurately mark up charts. When I’m actively trading, I’m often zoomed in on the five- or one-minute chart, without time to draw in trendlines or key levels.

This is why I set time aside in the afternoons and evenings to mark up the daily and weekly charts on stocks I’m watching. I find that I often discover the best plays during these high-focus study sessions … and I suggest you do the same.

Also, my kids are usually asleep at these times, which is always a plus for studying.

“I’m tempted to trade 0DTE puts on the major index volatility today, is this something I should avoid?”

First, I totally understand how tantalizing it can be to trade high-volume SPY contracts.

That said, this price action is way too choppy for me to recommend trading short-dated puts.

If you’re wrong or mistime your entry even slightly, your entire position could evaporate in minutes.

REMEMBER: You’ve gotta fight the urge to force trades just because the market’s volatile.

A volatile market doesn’t turn a mediocre setup into an excellent one — but it can certainly fool newbie traders this way.

I made this mistake when I was first starting to trade. As a newbie, I’d enter trades without an excellent setup and I paid the price.

I wish I could get in a time machine and tell my newbie-trader self to be even more patient than I already was.

I would have avoided some brutal losses — and potentially made even more money than I already have.

Today’s SPY setups remind me of some trades I wish I had avoided in the past.

So, take it from me. Unless you see a perfect setup that checks all of your boxes, avoid trading this ‘chopfest.’

Final Thoughts

Have a great weekend, Evolvers!

Next week is shaping up to be a potential rollercoaster ride.

Study hard, strap in, and buckle up!

Want to be alerted to hot trade ideas before anywhere else?

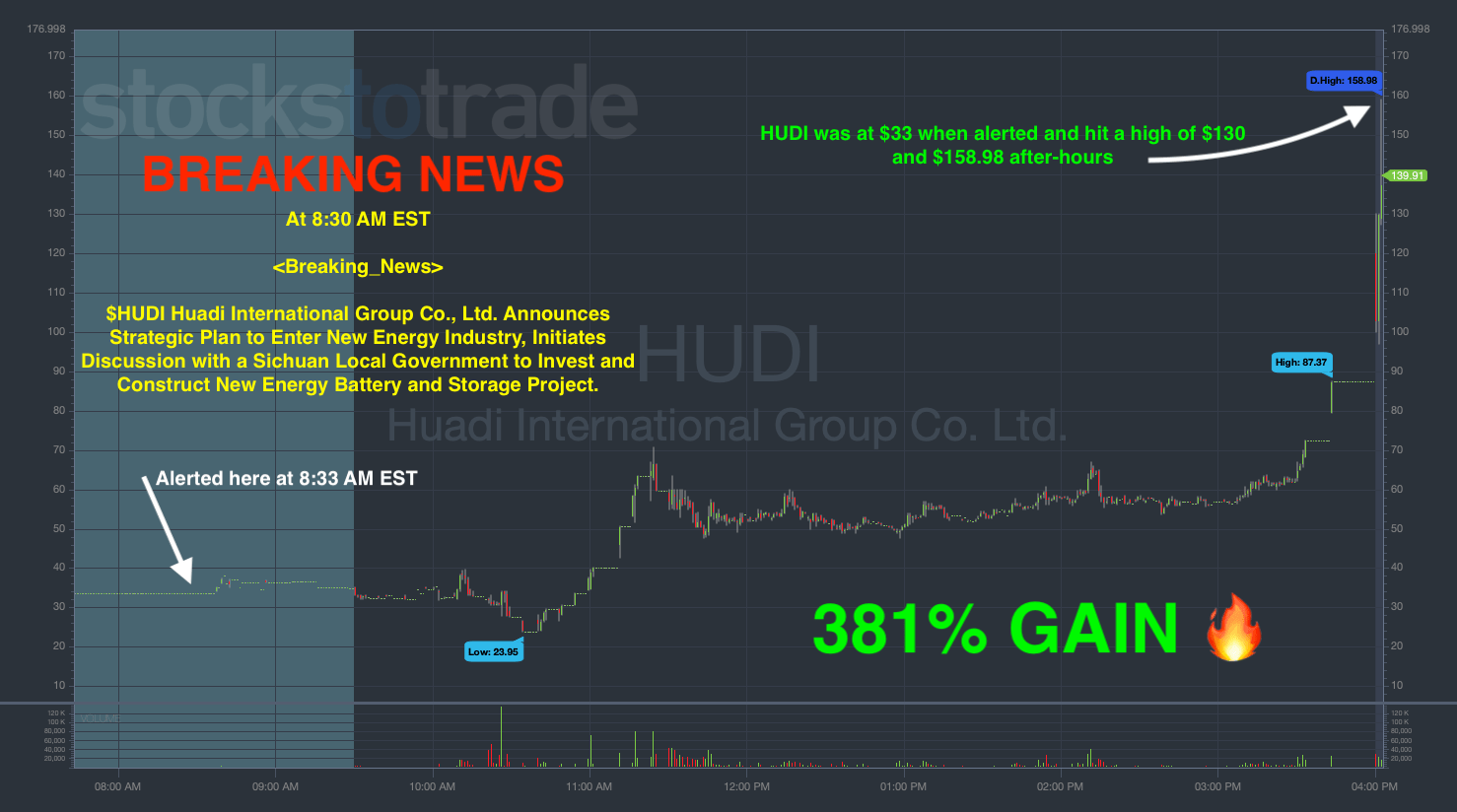

Breaking News Chat is the alert service that traders can’t get enough of. Two former financial analysts scour the stock market and news for stocks that could potentially spike and alert the room allowing you the chance to get in on the action.

Check out the alert for HUDI on November 3rd:

This is a tool you’ll want in your trading toolbox.