Happy Labor Day, Evolvers!

I hope you’re enjoying your day off, getting some fresh air, and studying hard!

And speaking of having the day off, now is the perfect time for me to go through some of the questions I’ve received over the past week.

So sit back, relax, and let’s do a special edition Labor Day Q&A.

Keep reading to see my answers to your recent questions…

“What’s your number-one potential play for this week?”

One setup stands out … I’m looking to buy calls on Carvana Inc. (NYSE: CVNA).

But before breaking this setup down, let’s look at the big picture…

For anyone unfamiliar, CVNA is an online used car retailer that’s been the subject of a massive short squeeze in 2023.

After languishing under $10 for the first half of the year amid bankruptcy rumors, CVNA started blasting off into a rip-roaring short squeeze in May…

From May 1 to July 19, CVNA moved from $6.93 to $57.29 — a gain of 725% in two and a half months!

These types of moves don’t usually happen without the assistance of a short squeeze. In particular, a gamma squeeze…

Traditional short squeezing is only half the story. Many don’t realize that option contracts play a vital role in the specific kind of squeeze mechanic that’s so common in today’s stock market.

As call buyers continue to slap on contracts, market makers are forced to buy the underlying stock to stay delta-neutral.

Without getting too deep in the weeds, this means that the more call options are bought … the higher the stock usually goes.

This isn’t a perfect science, but in the midst of a wild short squeeze, the phenomenon is hard to ignore…

And now, I think the CVNA chart is telling us something…

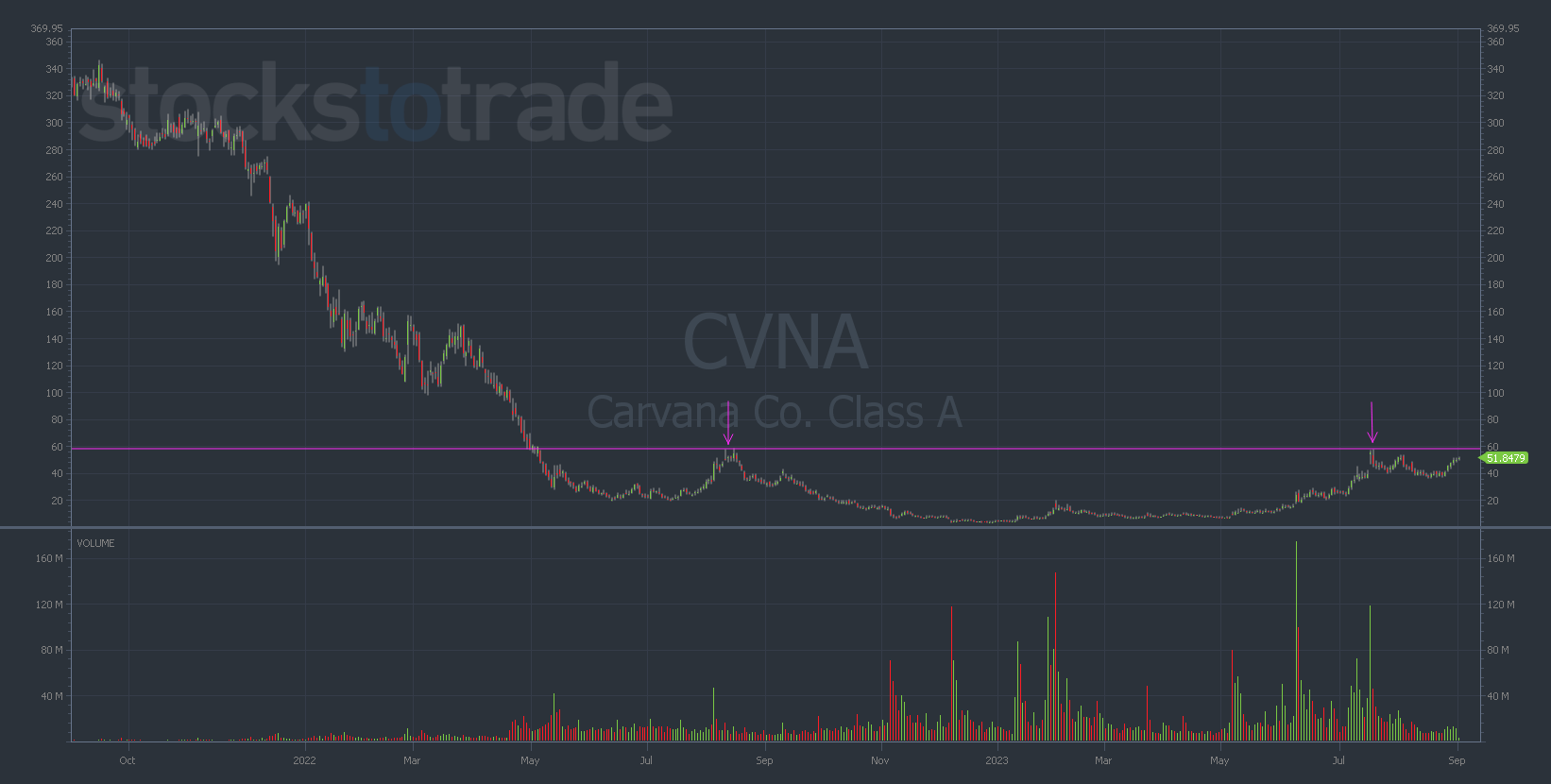

CVNA 2-year daily chart — courtesy of StocksToTrade.com

After forming a perfect double-top pattern at $58 (noted by the pink arrows), CVNA could’ve gotten slammed back to the downside over the past few weeks…

But instead, it’s been remarkably resilient…

Let’s zoom in…

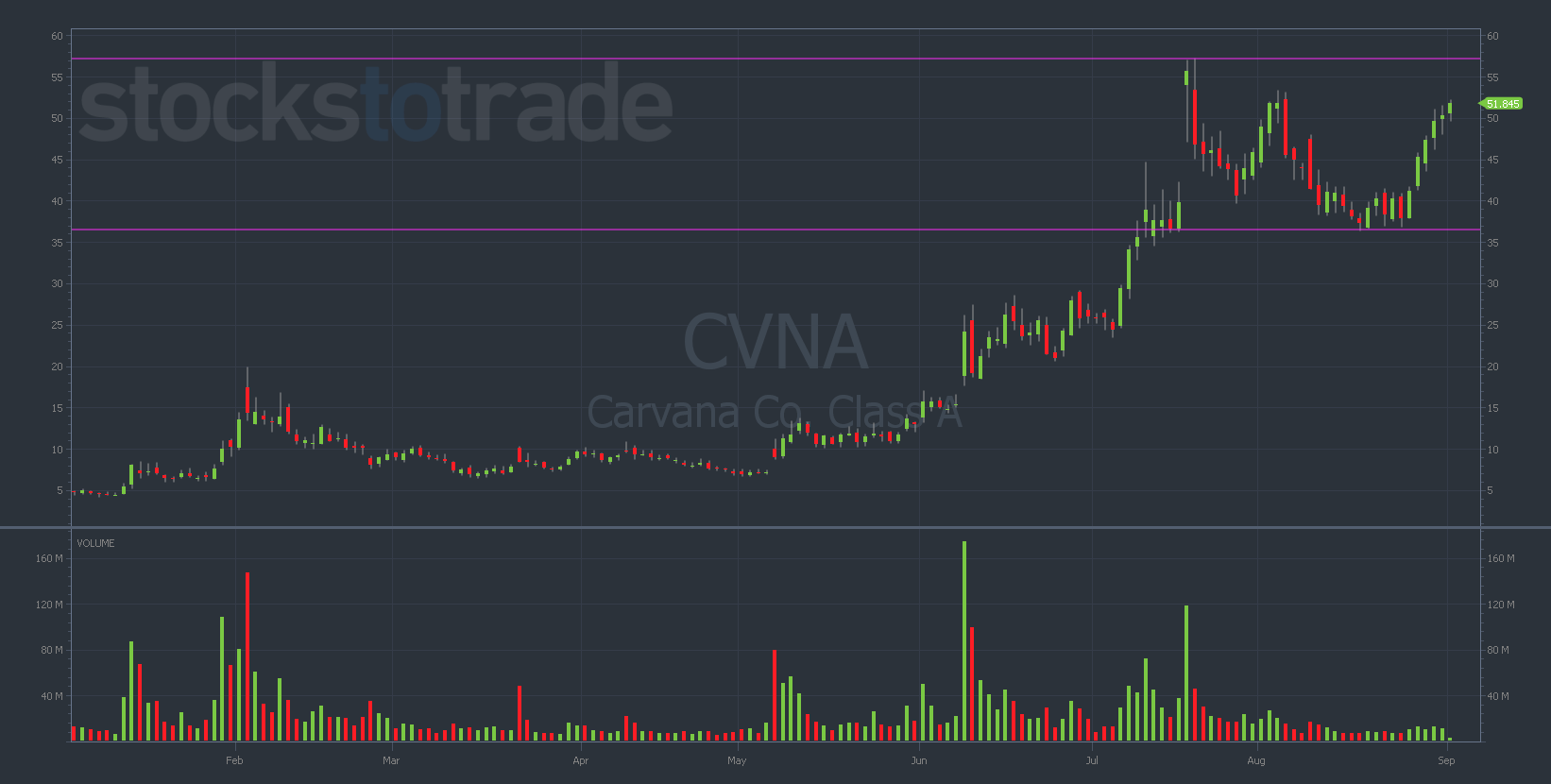

CVNA YTD daily chart — courtesy of StocksToTrade.com

The way it held support in the high $30s — refusing to dump following the double top — leads me to believe this stock could go a lot higher.

REMEMBER: At its all-time high in 2021, CVNA traded for $376.83!

So, I’m patiently waiting for the perfect opportunity to buy CVNA call options.

Specifically, if I see CVNA edging up toward $52-$53, I’ll be going long on calls.

That said, be aware of the risks with this potential setup…

Right now, CVNA has posted six green days in a row.

I want a pullback followed by consolidation before buying calls.

While I’m leaning bullish, there’s no such thing as a guarantee in the stock market.

Could it form a triple-top at $58 and then get destroyed? Sure. You should definitely be cautious around the $58-$60 level.

But personally, based on the technicals I’m seeing, I think that CVNA has more upside left in the chart.

Trade accordingly.

“How much IV is too much? “

This is an impossible question to answer definitively for every trade…

Sometimes, if a setup is perfect, you’ll want to ignore implied volatility (IV) and simply trade the price action.

This may sound counterintuitive, but for me, it’s true. Some of my biggest trades have been based on price, volume, and patterns … without really worrying about IV.

That said, in general, trading options without considering IV at all is a recipe for disaster.

We saw this recently with the way IV crush affected Nvidia Corporation’s (NASDAQ: NVDA) call options following the company’s recent earnings report.

Those who don’t understand IV may have been shocked to see their call options go from out of the money, to in the money … and still lose value.

So, your question is on the right track — how much IV should traders expose themselves to?

A good rule of thumb is to avoid contracts with IV in the triple-digits (100% or higher).

These will usually be weekly options on volatile names, but there are exceptions…

For example, a red-hot name right now is Vietnamese auto manufacturer VinFast Auto Ltd.(NASDAQ: VFS).

When this stock debuted two weeks ago, there were no weekly options, and many of the 9/15/2023 monthly contracts had 500%+ IV…

500%!

Plus, at the time of writing, every single VFS weekly call strike has an IV above 200%.

This is insane. 100% is a lot, but 200-500% is completely untradeable.

To draw a comparison, Apple Inc. (NASDAQ: AAPL) weekly at-the-money call options currently have an IV of around 25%.

In other words, you stand to make 8 to 20 times more on your AAPL contracts than you would on a comparable % move in the underlying shares of VFS.

Bottom Line: Trading options contracts with massively inflated IV is a bad move.

I’ll answer more questions on Friday.

Now, it’s time to start preparing for the trading day tomorrow.

And speaking of being prepared for the trading day…

Are You Ready To Level Up Your Trading Game?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!