The final weeks of December are here as 2022 comes to a close!

It’s no secret that this has been a brutal year for stocks…

But that doesn’t mean there haven’t been great setups.

What’s helped me most this year is having my watchlist in order at the beginning of every week and focusing on the charts that I’m familiar with.

I tend to go back to the same charts time and time again.

That’s because once I understand the personality of the chart, I have an edge. And that’s priceless in the markets.

Throughout 2022, I’ve found myself drawn to four charts in particular. I’ve traded these names over and over again. (One even brought me my biggest win of all time, but more on that later…)

Keep reading to see the four charts I couldn’t take my eyes off in 2022…

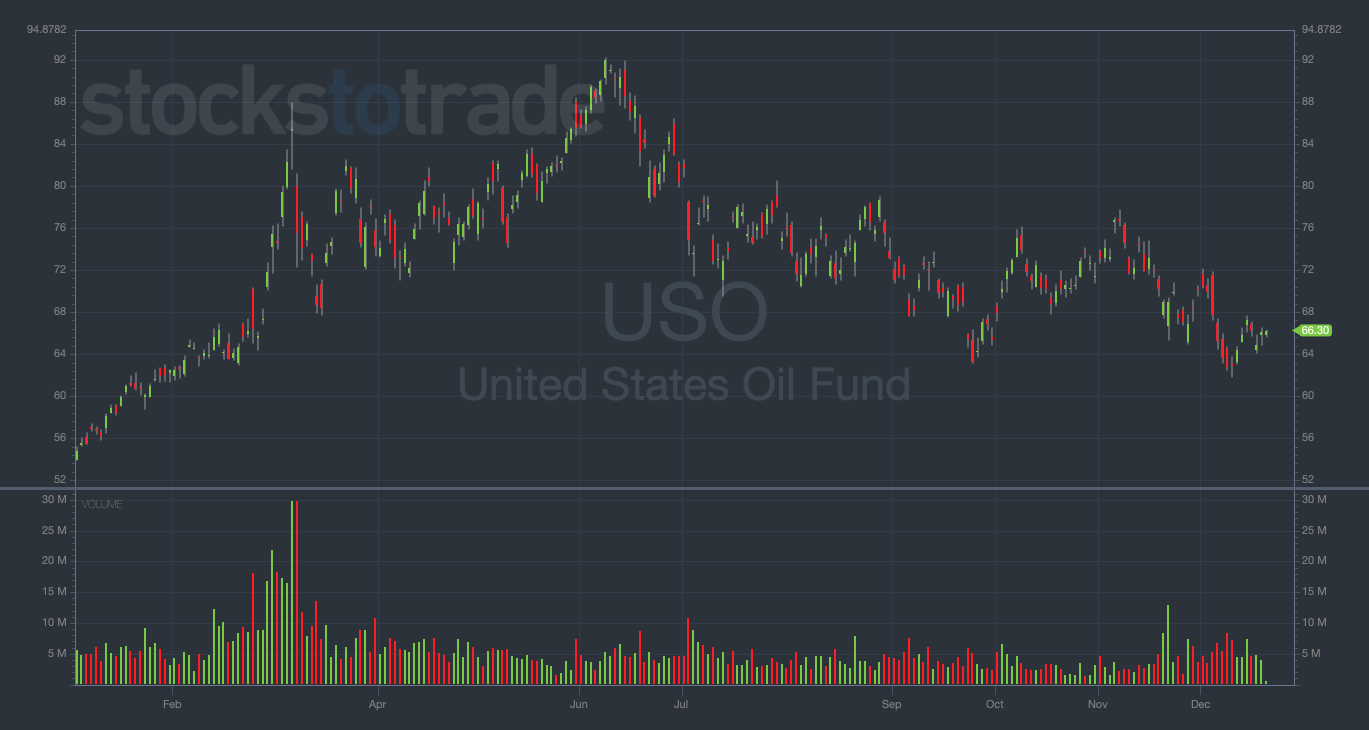

United States Oil Fund (NYSE: USO)

(USO YTD daily chart — courtesy of StocksToTrade.com)

One basket of stocks has surprised many traders this year … the energy sector.

In early 2022, a combination of war in Eastern Europe and worldwide inflation sent gas prices soaring … and oil stocks surging with them.

USO was up more than 70% in the first half of 2022, making it a huge standout in an otherwise bearish environment

But of course … what goes up, must come down. (I’ve made my fortune shorting stocks and buying puts due to this very principle.)

Just as USO attempted to get into the triple-digits, it saw a big rejection at $92, sending the stock into a brutal downtrend.

I called out this blow-off top back in March, so I hope some of you were able to profit from this play!

Today, USO is trading slightly up from where it began in 2022 … but not by much. Gas prices are almost back to where they were before Russia invaded Ukraine.

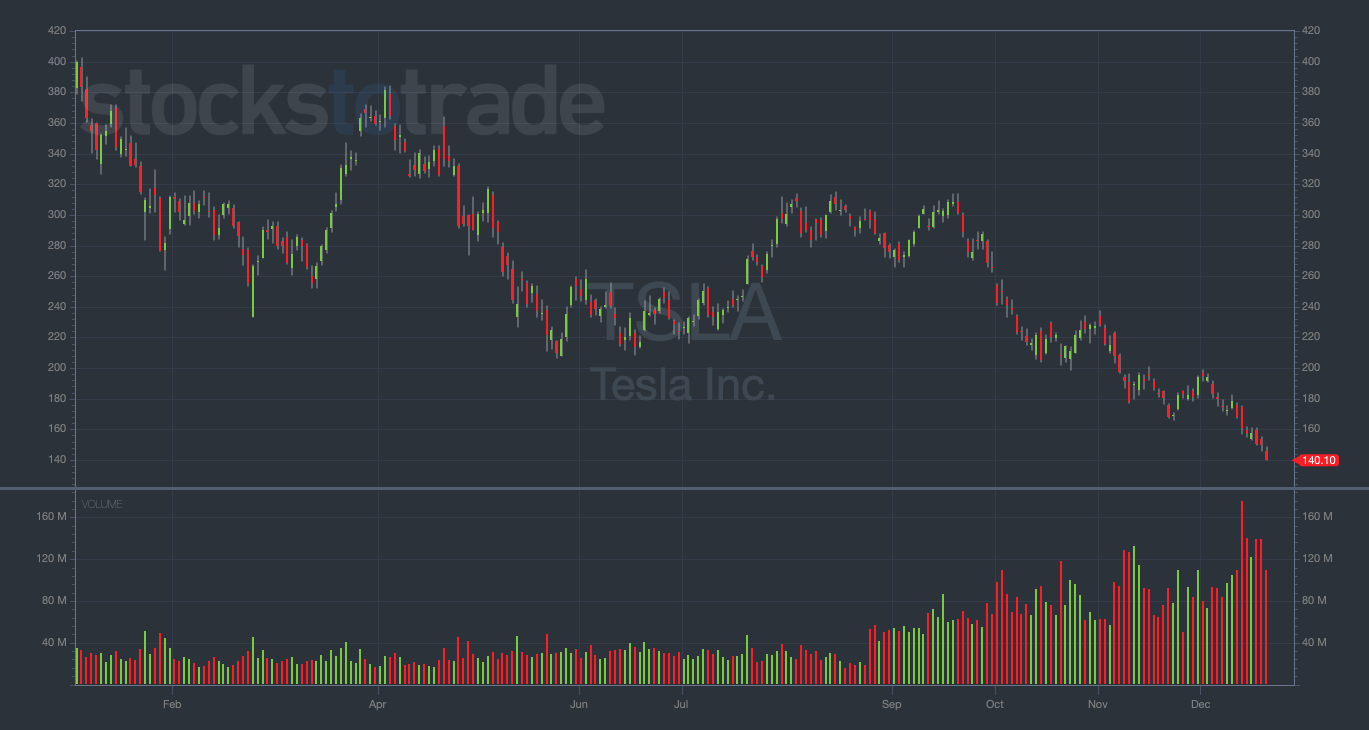

Tesla Inc. (NASDAQ: TSLA)

(TSLA YTD daily chart — courtesy of StocksToTrade.com)

Ahhh … my old friend, TSLA!

This chart checks a lot of my boxes and that’s why I’ve been trading it regularly for years now.

It displays huge gains in a short amount of time, experiences sharp reversals, and reacts strongly to news-driven catalysts.

Plus, CEO Elon Musk acts as a proxy for the entire momentum stock universe…

We’ve all seen how effective he can be in this regard. One tweet from Musk could make or break the week for TSLA stock.

And this year, one story has moved TSLA’s share price more than any other … Twitter.

Musk’s pricey Twitter acquisition has put enormous pressure on TSLA, opening up some juicy put-buying opportunities for those with the foresight to spot them.

Another reason I like the TSLA chart is its tendency to react predictably around key price levels. Time and time again, easy-to-identify levels (like the $1000 level, pre-split) have proven to be a huge test for the near-term direction of TSLA stock.

Finally, now that the stock has split a few times and the share price has come down, TSLA options are much more affordable.

This makes me think TSLA could be even more tradeable in 2023. Don’t take your eyes off this one!

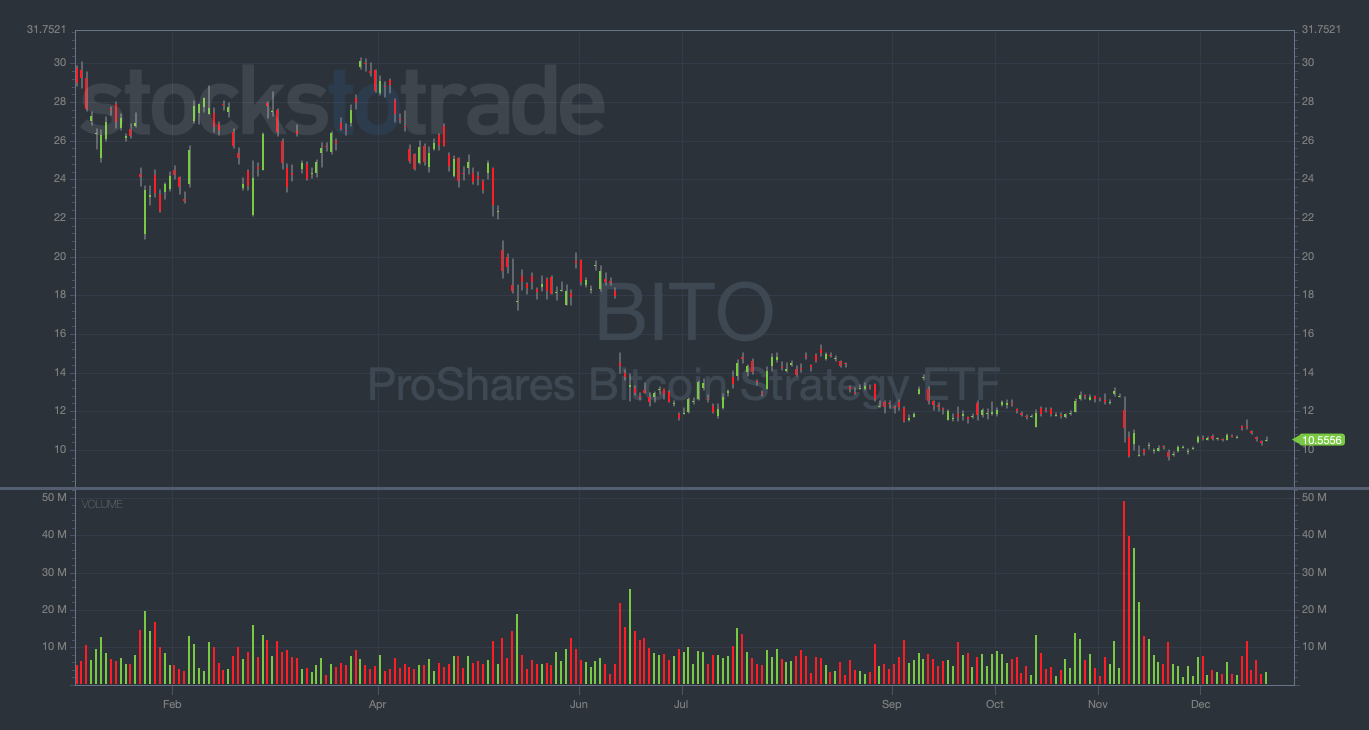

ProShares Bitcoin Strategy ETF (NYSEARCA: BITO)

(BITO YTD daily chart — courtesy of StocksToTrade.com)

Unless you’ve been living under a rock, you’ve probably spent much of 2022 listening to retail traders talk about BTC and crypto stocks.

I like to trade the BITO because it tracks BTC directly. (Plus, it’s optionable.)

Crypto has been impossible to ignore this year, but not for the reasons bulls would like.

Let’s rewind a bit…

In 2021, crypto was an absolute retail rocketship that showed zero signs of slowing down, until November…

Then, a big reversal at $67,000 sent the crypto markets into a tailspin.

Ever since this euphoric top was put in, BTC and crypto at large haven’t been able to recover.

To put this in perspective, BTC is down 65% YTD. Yikes!

Obviously, when BTC dumps, it dumps HARD (and brings the entire crypto market with it).

The broad moves in the BTC chart affect a handful of optionable crypto stocks like Coinbase Global Inc. (NASDAQ: COIN), Marathon Digital Holdings Inc. (NASDAQ: MARA), and Riot Blockchain Inc. (NASDAQ: RIOT).

In other words, you don’t need to set up a separate trading account to play crypto volatility. I’ve been trading options on crypto stocks all year (and it eventually paid off handsomely)…

In March, I bagged my biggest trade of all-time buying puts on BITO.

Heading into next year, I recommend that Evolvers watch them — and BITO — closely.

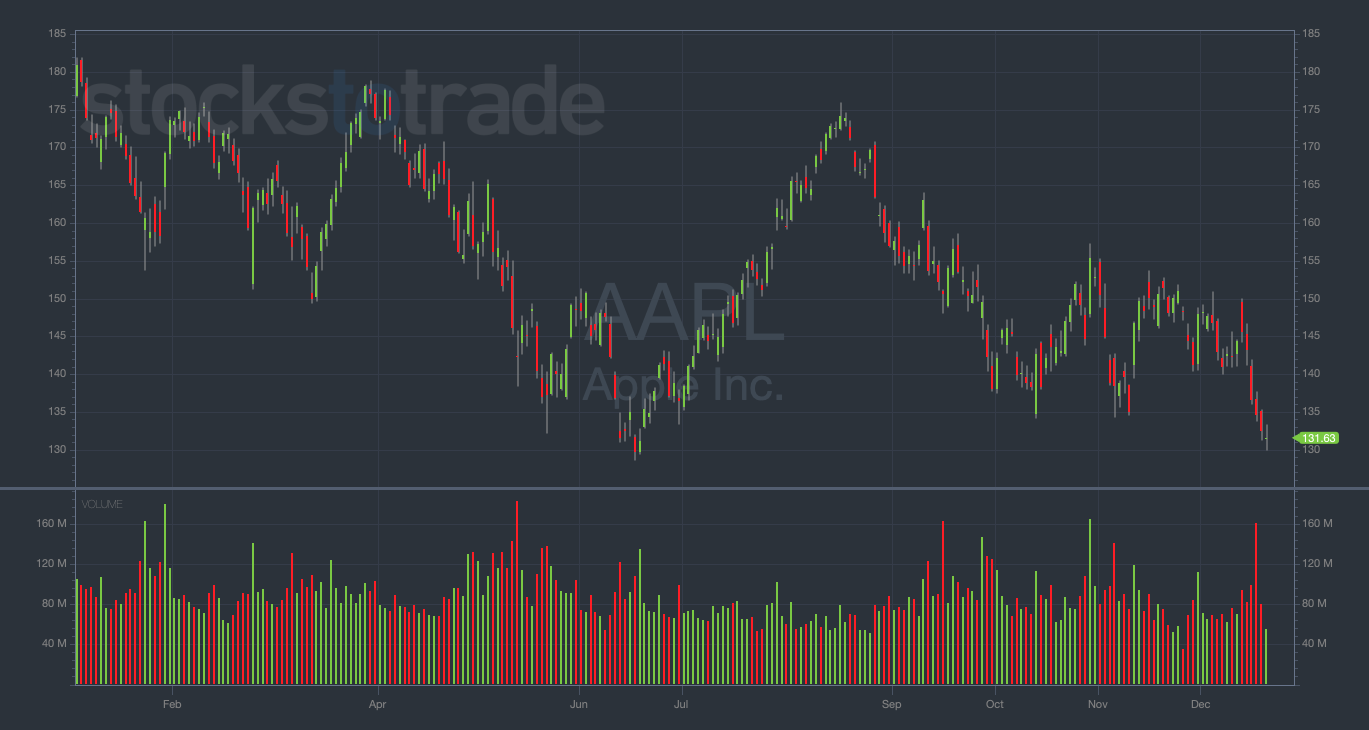

Apple Inc. (NASDAQ: AAPL)

(AAPL YTD daily chart — courtesy of StocksToTrade.com)

It’s hard to ignore the biggest company in the world…

AAPL was the major leader in the tech sector in 2021.

And last year, I predicted that it would take a broad market reversal for AAPL to see some serious downside.

Well, guess what happened…

In 2022, as tech stocks have faced major headwinds, AAPL lost 27% of its market cap.

That said, it’s held up better than many of its peers. The drawdown has been very orderly.

There are a few ways to look at the chart right now…

I’ve been watching AAPL throughout 2022, expecting a major drop at some point.

I don’t want to miss this, as a big downside move in AAPL could be truly epic for put trading.

But I’m constantly reminding myself that timing is everything. I’m mostly sitting on the sidelines, patiently waiting for the perfect moment to strike.

I’m now looking toward 2023 earnings as a potential put-buying catalyst for AAPL. I think we may start to see interest rates seriously affect the earnings cycle next year.

On the other hand, AAPL is now sitting near some very strong support near $130. If it holds this level, it could bounce hard in the near term.

And at the end of the day, this is why I love the AAPL chart. It has defined ranges that are relatively simple to trade against.

Final Thoughts

There you have it, Evolvers — four stocks that I’ve found at the top of my watchlist nearly every week in 2022. These are my favorite stocks to trade!

The charts are perfect for my trading style — volatile, catalyst-driven, and ripe for options trading. Don’t sleep on them.

Hopefully, you now have a better understanding as to why I’m so interested in these charts.

Bookmark them heading into 2023. We could see further opportunities in these names soon.