Are you trying to gauge the market’s reaction to all of last week’s major news catalysts, and make good trades in the process?

Well, we have a lot to talk about, then…

After all, the regional banking crisis continued to affect a wide variety of stocks just as the Fed’s FOMC meeting went into full swing…

A lot has happened over the past week and I don’t want you to get caught flat-footed as you face the volatility.

Today, I’ll explain why now is the time to be practical and economical with your trading positions.

Keep reading and I’ll show you two simple ways to potentially accomplish this.…

Trade One Day at a Time

In the current market environment, I think it’s best to focus on trading one day at a time.

Instead of making long-term predictions or holding positions for a long time, stick to short-term plays that aren’t dependent on what the market does next week or next month.

Trying to make bets on future trends in this everchanging market can lead to disaster.

For now, don’t hold contracts for more than a day or two unless specific technical indicators are telling you to do so.

And if you do have the feeling that the trade may continue in your direction … sell part of your position to lock up safe profits while allowing a small portion of contracts to continue riding.

Great traders know how to be patient with their runners and incredibly impatient with their losers.

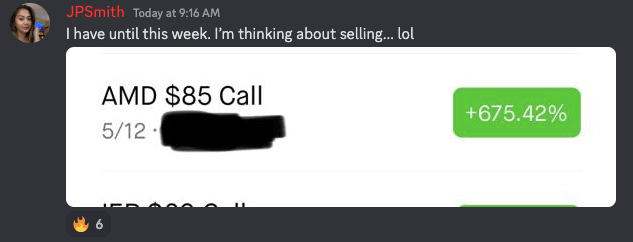

For example, my always-impressive student, Jenny Smith, has been holding runners to astounding results recently…

Jenny knows how to identify which trades are ‘runners’. Then, she holds a portion of the position for home run potential.

But this isn’t advisable for the average trader. In this market, take your wins while you have them, and don’t let losses snowball.

Adaptability is key during this time, and it’s important to adjust your strategy according to the market’s demands.

Furthermore, there’s a big difference between sticking with your winners and getting married to trades…

Don’t Get Attached to Your Positions

It’s a big mistake for traders to become too attached to their positions. I’ve seen it happen many times before…

A trader will form an opinion about a particular stock or industry and get stuck in that mindset.

Even when the price movement strongly indicates the opposite, they refuse to admit they were wrong.

Here’s the most important point: as a trader, making money should be your priority, not proving yourself right.

Take it from me…

For much of 2022, I believed there would be a significant decline in the crypto markets.

To prepare for this, I took a substantial position in puts on the ProShares Bitcoin Strategy ETF (NYSEARCA: BITO), which would profit if the crypto market crashed by March.

However, I was quickly proven wrong when the entire sector began surging against my position at the same time. I knew I needed to change my plan … fast!

So, what did I do? I started buying calls on crypto stocks instead and eventually cut my entire short position.

If I hadn’t made this adjustment, I would have taken some enormous losses. (BITO is up 51% YTD!)

So, here’s the lesson I want you to remember … Don’t be afraid to admit when you’re wrong or if your timing is off with a trade you’re making.

When you see the price action going against you with high trading volume, cut your position (and even consider taking the opposite side of the trade).

By switching sides in time, a trade that would have been a significant loss could potentially turn into a win.

But if you stubbornly cling to your incorrect predictions, you’ll get destroyed.

Consider these facts as you’re trading this week.

Final Thoughts

I’ll be honest, I don’t have a lot of stocks on my watchlist or setups I’m eyeing right now.

I’m playing it safe and, of course, considering these tips for any trades I do take on.

Join me in being patient and trading smart.