After surging over the last two months from a low of $365 to a high of $429, the S&P 500 ETF Trust (NYSEARCA: SPY) is starting to reverse back to the downside.

I’m thinking now’s the time for Evolvers to capitalize on the end of the bear market rally.

That said, there are thousands of optionable stocks in the market.

So how do you know which names to short, what puts to buy?

You can always keep things simple by buying put options on the SPY itself. There are several benefits to doing it this way…

First, it’ll prevent you from having to track multiple open positions at once. Plus, the SPY chain is one of the most liquid in the entire options market, so you’ll never have to worry about big bid-ask spreads.

But as I examine the markets this week, I think there might be some even juicier options to play on the downside.

In particular, two charts are impossible for me to ignore right now. Both are presenting potentially five-star put setups.

Keep reading and I’ll reveal the two charts I’m watching like a hawk right now…

United States Oil ETF (NYSE: USO)

The first chart that caught my eye is part of the only sector that’s seen any kind of sustained gains throughout 2022…

You guessed it, I’m talking about oil stocks. In particular, I’m keeping USO at the top of my watchlist.

I’ve had my eye on the energy sector since March when I perfectly called the top.

I also mentioned in some recent webinars that I thought we were getting close to a potentially great trade opportunity in the sector…

Now, I think that opportunity may be right around the corner. Take a look at the daily chart…

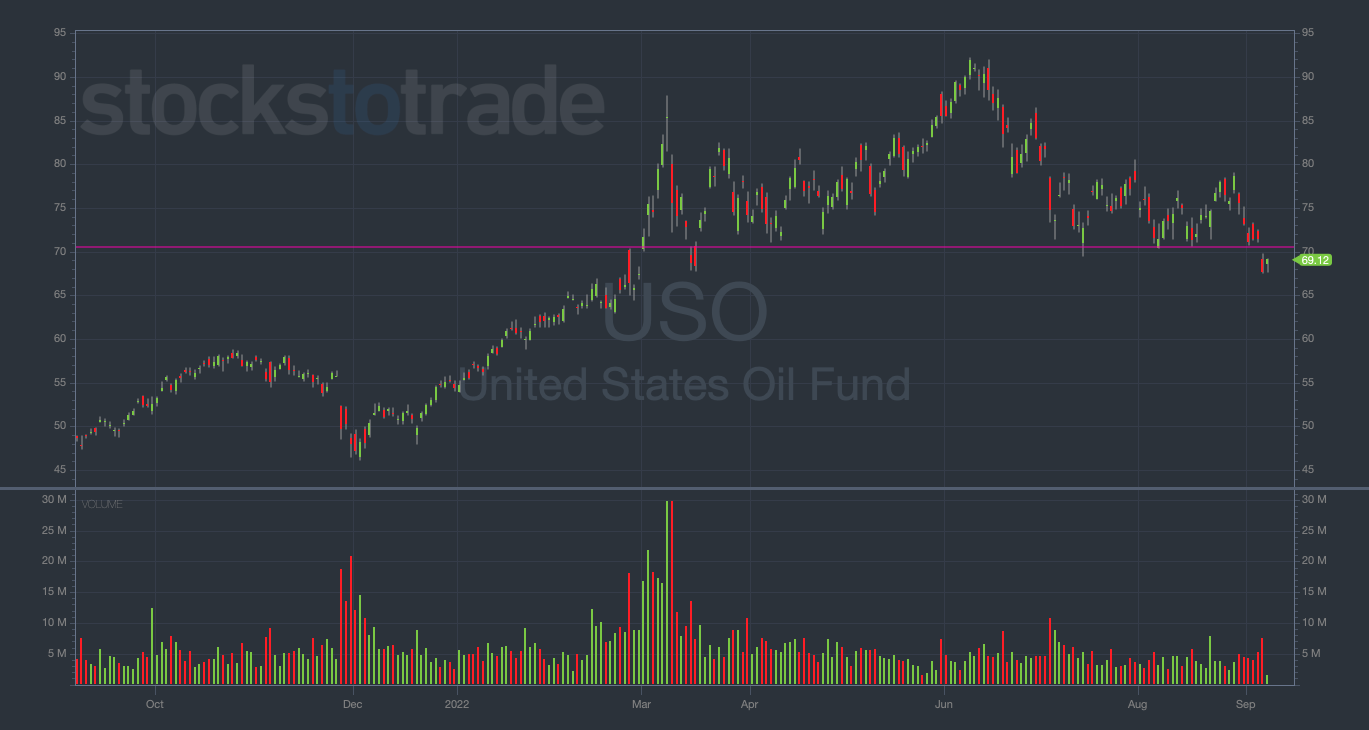

USO YTD daily chart — courtesy of StocksToTrade.com

Notice the pink line I drew which corresponds with USO’s multi-month support just above $70.

Now, take note of the fact that USO has recently lost this critical support level. (And remember that identifying key price levels can often lead to incredible trading opportunities.)

I think this is the initial dip, but it could turn into a steep drop in oil stocks.

Don’t ignore this sector. Look at the big picture…

USO is still up more than 25% YTD, leaving plenty of room for further downside.

I haven’t put a trade on yet, but I’m seriously considering buying some USO puts heading into the end of the week.

ProShares Bitcoin Strategy ETF (NYSEARCA: BITO)

Next, as crypto is getting hammered into oblivion (which I recently predicted), I’m watching my old friend BITO.

BITO is one of my favorite ways to play dips in the crypto markets for a few reasons…

- It’s optionable

- It perfectly tracks the Bitcoin (BTC) chart

- I’m very familiar with the personality of the chart

- I’ve crushed it trading this stock in the past

There are other optionable ‘crypto stocks’ to consider, like Coinbase Global Inc. (NASDAQ: COIN), Marathon Digital Holdings Inc. (NASDAQ: MARA), and Riot Blockchain Inc. (NASDAQ: RIOT) … but I think BITO is the simplest, most direct way to short BTC via options.

I think a devastating crash could occur in the crypto markets, and I wanna be there to capitalize when it happens.

Take a look at this chart…

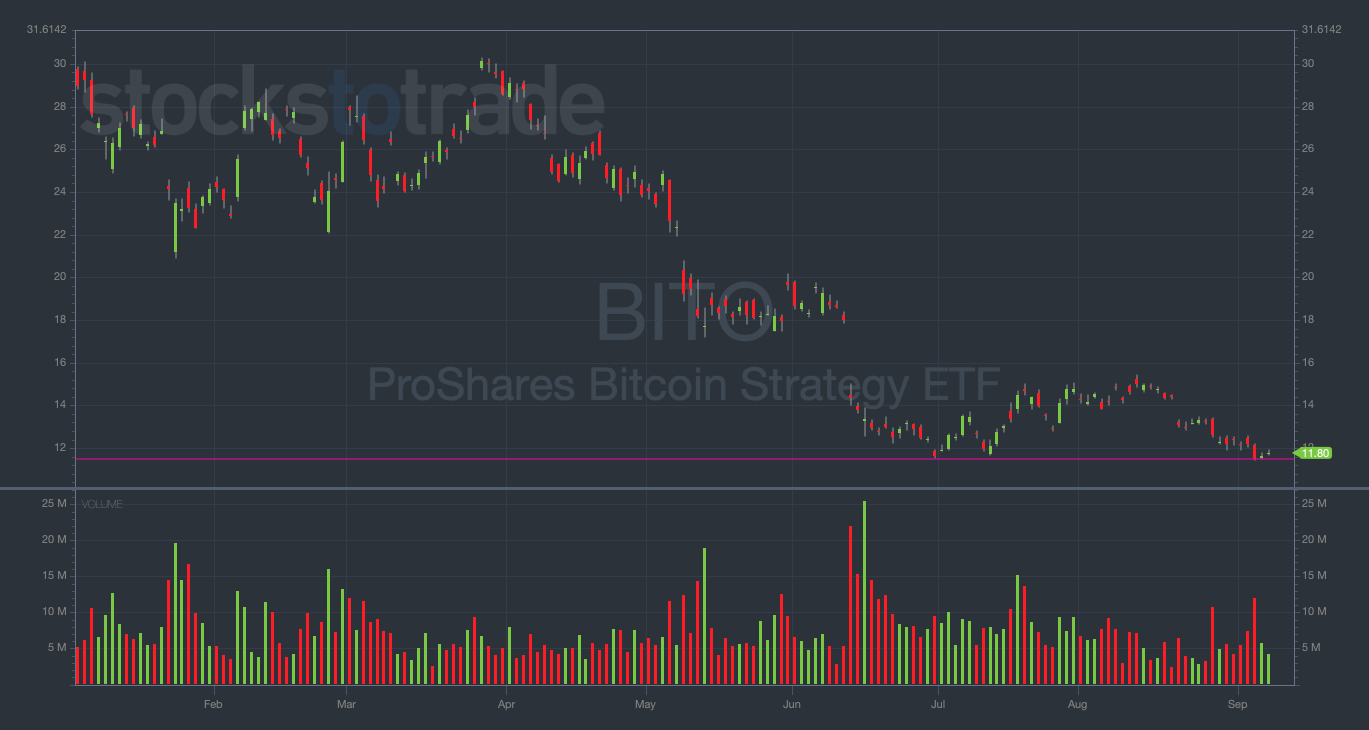

BITO YTD daily chart — courtesy of StocksToTrade.com

At first glance, it may appear as though this chart is near its bottom, but I beg to differ…

BITO is a relatively new ETF, so this chart doesn’t go as far back as other crypto stocks (when the entire sector was stuck in a ‘crypto winter’).

The way I see it, after $20,000, BTC doesn’t have any real support until $10,000.

If I’m right about this, BITO could drop as low as $6, meaning there’s potentially 50% downside left on the chart.

Now, it goes without saying that I’m skeptical about crypto. However, that doesn’t mean I don’t have an open mind. So when my mentor Tim Sykes, and millionaire trader Matt Monaco tell me there is something big brewing in the space, you better believe I’ll be listening in…

Don’t miss Tim and Matt’s emergency interview — The Final Crypto Shock — on September 15 at 8pm Eastern … click here to reserve your spot BEFORE it’s too late!

That said, so far, my personal outlook on the sector hasn’t changed. I’m looking at 9/30/2022 BITO Puts, but I haven’t pulled the trigger on a particular strike yet.

I’ll let you all know if and when I do.

Final Thoughts

While much of the market is panicking, you can (and should) be capitalizing.

This is how I’ve made my fortune … by identifying short setups, then striking while the iron is hot (and the market is cold).

These two setups check all of my boxes. Stay tuned to your inbox for further updates on how I may play these stocks.

The Millionaire Strategy ANYONE Can Use

Tim Sykes here…

Twenty-five of my millionaire students have used this exact pattern…

To reap trading profits of $36,125… $68,214… and even $681k all in a single day.

And I KNOW it could potentially do the same for YOU!