Happy Friday, Evolvers!

Considering the fact that I’ve already done two FAQ sessions this week…

Today, we’re taking a break from our normally-scheduled Friday Q&As to continue reviewing my trades from the first half of the year.

If you missed part I, go back and read this first.

Everyone else, keep reading to see the second half of my 2023 mid-year trading review…

My Worst Trades So Far in 2023

After reviewing my best trades yesterday, let’s move to the ugly side of my 2023 performance.

ATTENTION: Learn from my mistakes so that you don’t make them yourself!

With that in mind, here are some of the worst trades I’ve executed so far this year…

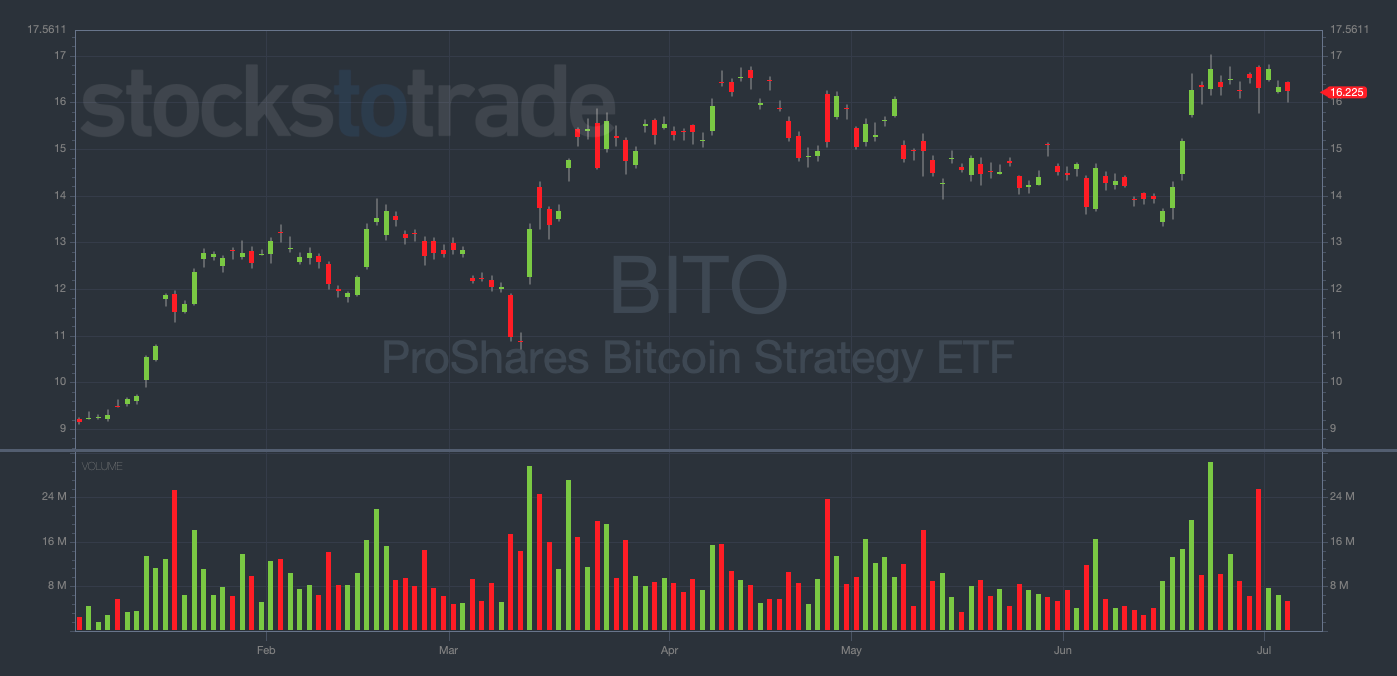

‘Swing’ Puts on the ProShares Bitcoin Strategy ETF (NYSEARCA: BITO)

BITO YTD daily chart — courtesy of StocksToTrade.com

At the beginning of the year, Bitcoin (BTC) was trading for $16,605 … and I was betting it would go even lower.

I thought the crypto party was over after the downfall of Do Kwon, Sam Bankman-Fried, and a variety of other sector implosions…

The way I saw it at the time, it wasn’t a matter of if crypto stocks would tank, only when…

You see, there’s rarely much rhyme or reason to what goes on with cryptocurrency and its related stocks like Coinbase Global Inc. (NASDAQ: COIN), Marathon Digital Holdings Inc. (NASDAQ: MARA), and Riot Blockchain Inc. (NASDAQ: RIOT).

Plus, I’m pretty bearish on crypto in general, so I have a slight bias toward trading puts on the sector.

So, at the beginning of the year, I started to build a mid-to-long-term puts position in BITO, a fund that tracks BTC directly. I risked just over $90,000 on the trade.

But I was wrong. BTC started 2023 strong, making a move up to $20,000.

When I saw this move to the upside, I realized I had to cut the loss. This was a big position and I couldn’t risk losing nearly six figures on one trade.

I exited the first leg of the trade at -$46%, losing $42,227.86! Then I closed another leg -33%, losing an additional $23,873,69 for a total loss of -$66,101.55!

And as bad as this loss was, it’s a good thing I cut it when I did…

In March, BTC (and crypto at large) began surging. The world’s #1 cryptocurrency went from $20,000 to $30,000 in just six weeks.

Had I stubbornly held on to this trade, I would’ve lost tens of thousands more.

Now, let’s recap. I learned a few important things from this trade…

The first is that I should primarily stick to my short-term, weekly options strategy. I’m not a swing trader by nature, and this trade was a good reminder of that.

Second, this trade was an excellent reminder of the importance of cutting losses quickly.

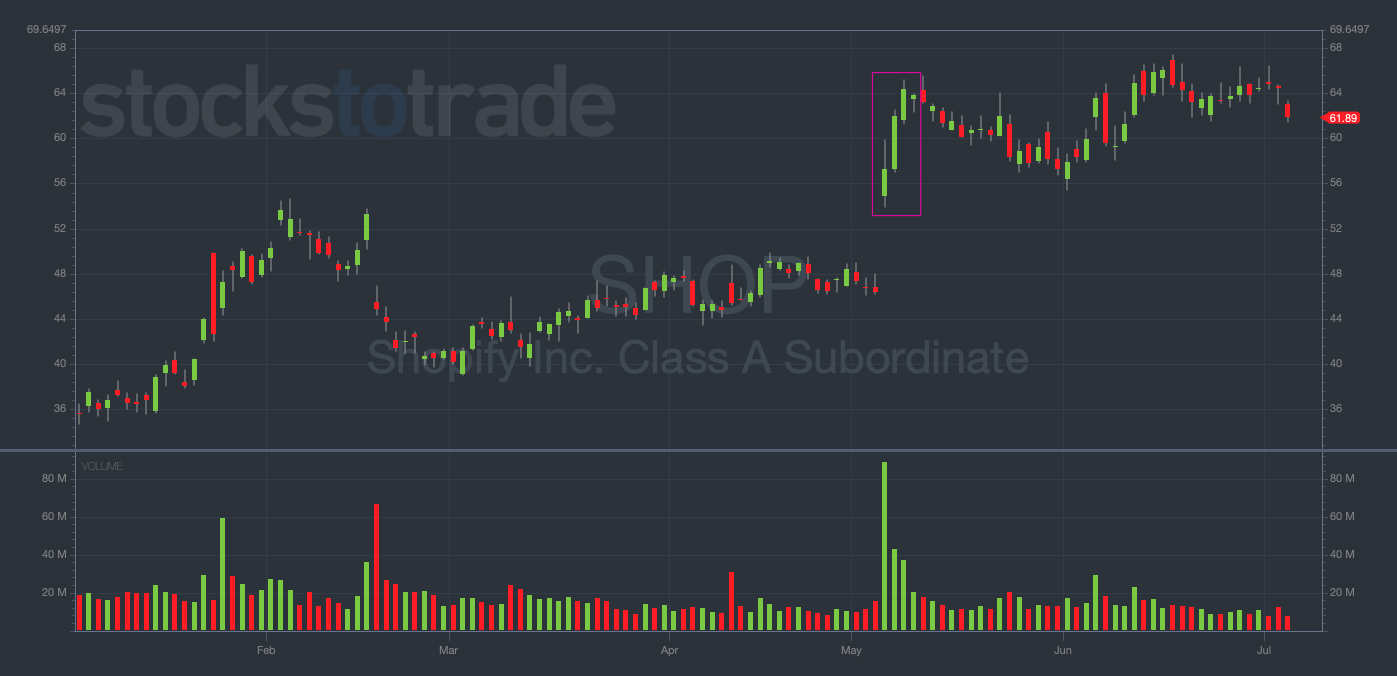

‘FOMO’ Calls on Shopify Inc. (NYSE: SHOP)

In mid-May, I was keeping a close eye on SHOP as the stock was ripping to the upside…

SHOP YTD daily chart — courtesy of StocksToTrade.com

At the beginning of that month, I wrote about two big missed trading opportunities, SHOP being one of them.

That missed opportunity was still fresh in my mind. I saw so many other traders profiting on SHOP, knew I had missed the boat the first time, and wanted to get in on the action…

In other words, I let the fear of missing out (FOMO) pull me into a subpar trade…

And on Monday, May 22 … I bought 100 5/25/2023 SHOP $64 Calls for $1.02.

But I didn’t keep my SHOP trade on a short enough leash…

I should’ve identified SHOP’s weak Monday close as a signal to reduce (or cut) my position.

But instead, I broke my rules and held the calls into Tuesday, which turned out to be a big mistake…

SHOP dropped more than 6% intraday and I was forced to sell my calls for $0.36 … a 65% loss!

Every trader will face moments such as this one. A bad trade forces you to take a long hard look at your strategy and fix what’s not working.

ASK YOURSELF: Do you let your losing trades shatter your confidence, or use them as motivators to avoid similar losses in the future?

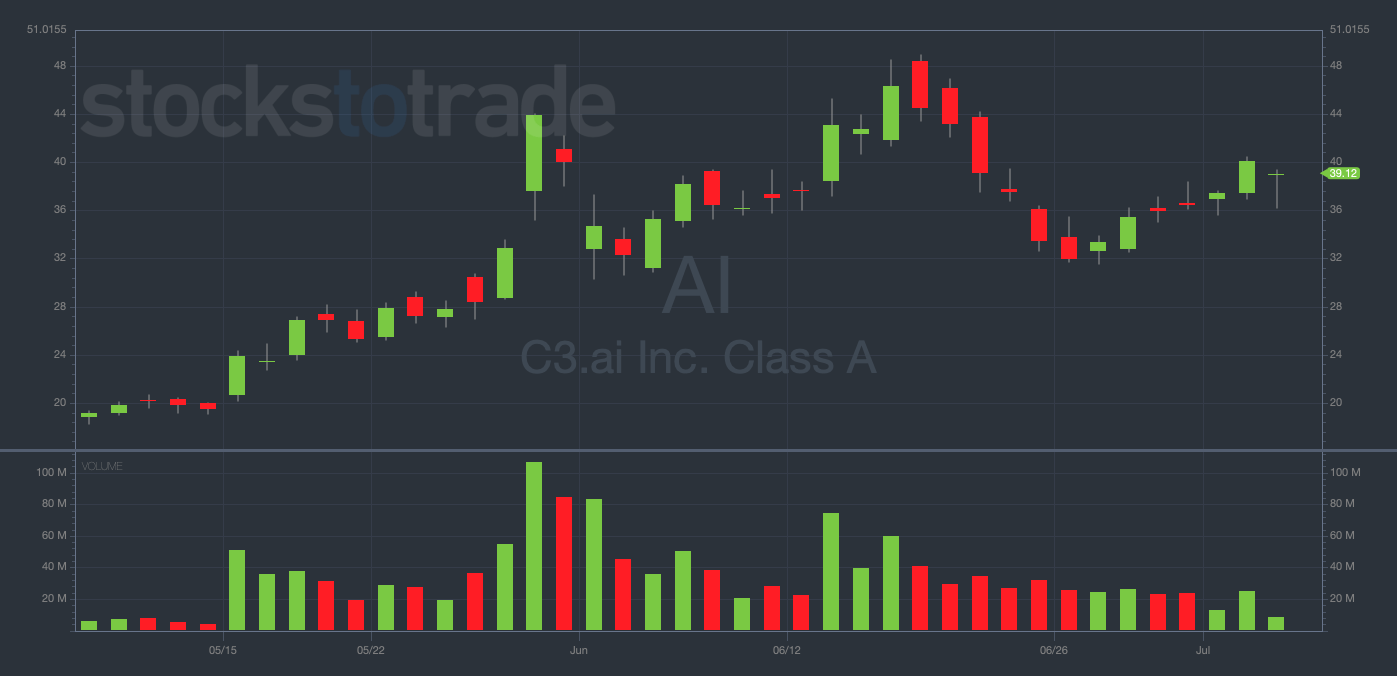

‘Fighting the Trend’ Puts on C3.ai Inc. (NYSE: AI)

Two words have dominated the stock market in 2023 … artificial intelligence (AI)!

Ever since the introduction of ChatGPT, the trading world has been mesmerized by the possibilities of AI.

And the poster child for this major move has been none other than C3.ai Inc. (NYSE: AI), with the stock up 250%+ YTD…

Anyone familiar with my trading tendencies will know that this sort of move is exactly what I look for.

Why?

Because when a stock in a red-hot momentum sector gets wildly overextended … a beautiful put-trading opportunity is usually right around the corner.

And I thought I was timing that moment well when, on June 7, I bought AI 6/16/2023 $30 Puts for $0.65…

AI 2-month daily chart — courtesy of StocksToTrade.com

But unfortunately, this time, my timing was off…

Over the next few days, AI surged from $36 to $49, and I was forced to sell my puts for $0.20 … a 69% loss!

What’s worse is that I was right about the general direction of the move, just wrong about the timing…

Once AI topped out at $49 later in the week, it immediately started dumping, eventually trading down to $31 over a ten-day period.

Had I simply waited a few days to enter and bought, say, $45 puts near the top … I would’ve executed an absolutely incredible trade.

But as usual, hindsight is 20/20. Here’s what I see now…

Timing is one of the most difficult aspects of trading, and it’s my personal ‘Achilles heel.’

Many of my big losses happen due to poor timing, even when I correctly predict what move will take place.

REMEMBER: You can be 100% on the direction of a move, but if you’re wrong on the timing, you might as well be 100% wrong!

Final Thoughts

That wraps up my mid-year trading review!

Doing these reviews helps me to identify my strengths and weaknesses, and I hope they’ve helped you as well.

Have a great weekend and I’ll talk to you on Monday!