Tell me if this has ever happened to you…

You’re watching two charts, each one potentially unfolding into a juicy put-buying opportunity…

But you know you shouldn’t split your focus into two simultaneous trades. You must choose one or the other.

Every trader faces a fork in the road like this from time to time. And it’s not always easy to decide which setup deserves your undivided attention…

This exact scenario happened to me yesterday. I was trying to decide between trading two setups … and I made the wrong choice.

If you wanna see where I went astray — and how you can potentially avoid similar errors in your own trading — keep reading and I’ll show you…

Palantir Technologies Inc. (NYSE: PLTR)

PLTR is a stock I haven’t traded much in the past but have been keeping my eye on for a while now…

The big data analytics company has been a popular stock among retail traders for years now, but it’s been stuck in a narrow trading range…

For much of 2022 and 2023, PLTR traded between $7-$10.

When stocks are stuck in narrow ranges like this, there’s not enough upside (or downside) in the chart to get me interested.

It wasn’t until the beginning of May that PLTR started to make serious moves, surging from $10 to $15 in just two weeks!

This piqued my interest, to say the least…

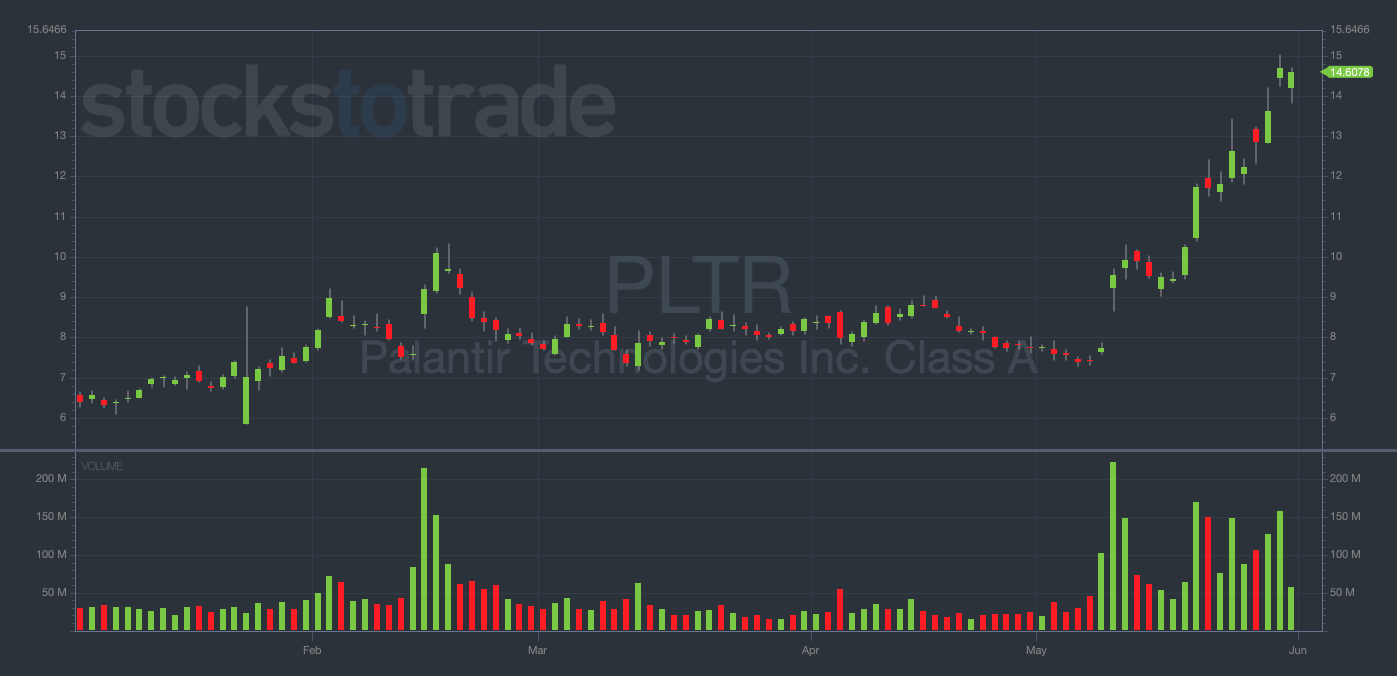

PLTR YTD daily chart — courtesy of StocksToTrade.com

When a popular momentum stock gains 50% in a short period, I’m on high alert for put-trading opportunities. (You should know this by now!)

And with PLTR, a few obvious topping signals have been coinciding at once:

- The stock got rejected at $15, an important round-number resistance level…

- Wednesday was the first red day for the stock in several weeks…

- The 14-day relative strength index (RSI) is above 70, indicating that the stock is massively overbought…

The confluence of these indicators led me to buy PLTR 6/2/2023 $14 Puts for $0.51 on Wednesday.

My risk was $14.50 and my price target was in the low $13s.

But, wait…

As I’m writing this, the stock has run from $13.90 to the low $14s, and I’m now cutting the position…

This is why determining your risk level is so critical…

PLTR broke out above $14.50 intraday, so I’m sticking to my rules and getting out of the trade.

I won’t sugarcoat it, this trade was an example of very poor risk management on my part … I took a 50% loss!

That said, it could’ve been an even bigger disaster had I not been disciplined about cutting the position when it exceeded my risk level.

And even worse, by zeroing in on this subpar PLTR trade, I missed a five-star opportunity elsewhere…

Nvidia Corporation (NASDAQ: NVDA)

Unless you’ve been living under a rock for several months, you know all about NVDA…

Not only have I written about this stock extensively, but the entire market has arguably been buoyed by the chipmaker’s incredible performance in 2023.

There’s not much I can say about the big picture of NVDA that I haven’t already, but I’d like to break down a textbook setup the stock recently provided

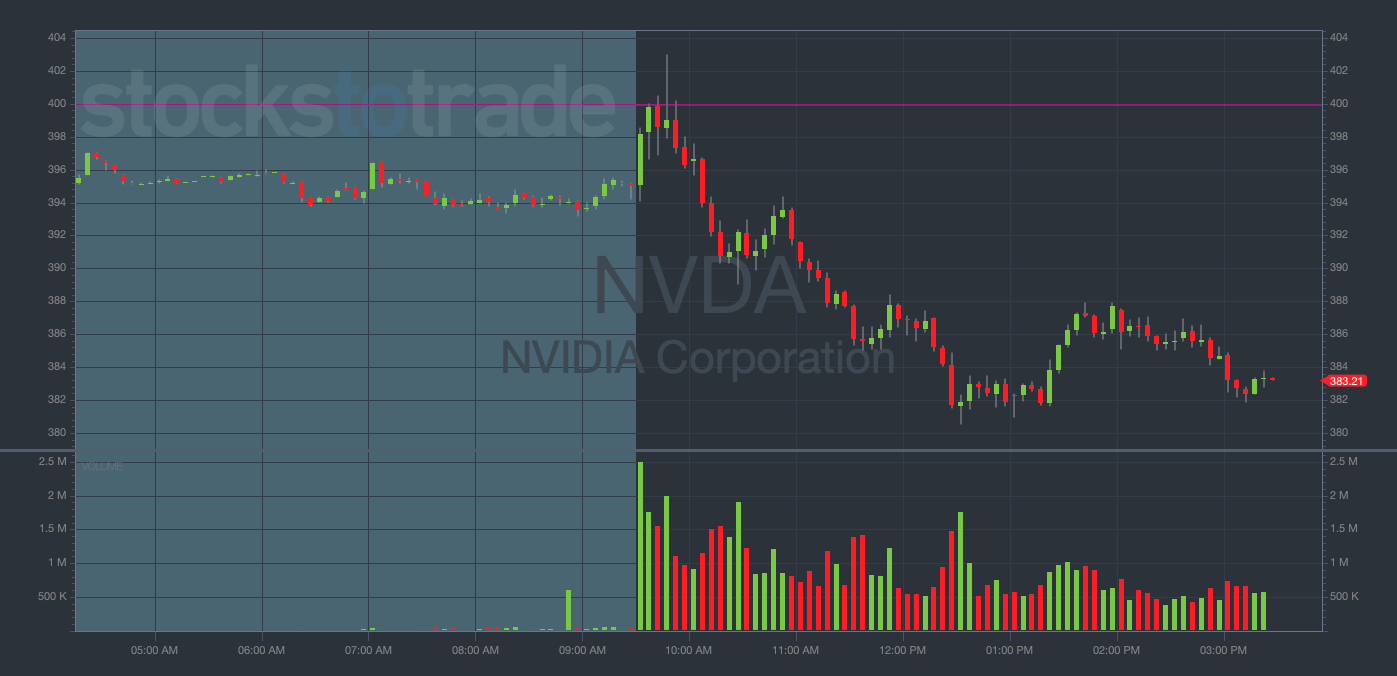

On Wednesday morning, NVDA got rejected at $402 and couldn’t close a 5-minute candle above $399.80. (Just like PLTR, it’s important to pay attention to rejections near big round numbers.)

Look at the intraday chart from Wednesday…

NVDA 5-minute chart from Wednesday, May 31 — courtesy of StocksToTrade.com

In hindsight, the rejection at $400 was an ideal time to get into short-term puts.

The move simply happened too quickly and I wasn’t able to capitalize in time.

(Spoiler Alert: I was too focused on PLTR!)

I missed this trade, and I learned a lot by missing it. Maybe you will too.

Check this out…

I ended up looking at a new play in PLTR when I should’ve been focusing on NVDA (a stock I have a ton of experience charting and trading).

Considering how well I know the NVDA chart, it’s disappointing that I haven’t been able to nail a big trade on the stock’s recent volatility.

I felt I was too late to trade the upside last week, and now, I’ve also missed the first red day.

But I learned a valuable lesson from all of this … focus on the charts you know. Don’t try to get fancy in this market.

I’ve been patiently waiting for my opportunity to enter NVDA puts, yet I missed the perfect moment because I directed my attention toward another (less ideal) setup.

Think about it. You can only really pay attention to one or two charts at a time. Don’t overcrowd your watchlist with subpar plays.

Final Thoughts

The truth is … I’m not trading my best right now.

But it helps me a lot to write these letters to you.

I get to work through my mistakes and, hopefully, help you avoid making similar ones.