Every six months, I like to take a step back and review all of my trades from that period.

I’ve said it before and I’ll say it again … self-reflection is critical for traders.

If you don’t examine your trading, you’ll never know which strengths you should lean into or what weaknesses you can improve upon.

I find that these mid-year reviews not only help you understand my trading mindset but also help me to form a comprehensive view of my performance.

The bottom line: I’m always looking for ways to improve my trading … even if it’s by a small fraction.

And it’s been a historically bad first half of the year in the markets — the worst start for the S&P 500 since the Nixon era.

My 2022 trading, however, has been more of a mixed bag. I’m incredibly proud of some of my plays — and downright disappointed in others.

Keep reading and I’ll walk you through my mid-year review…

January: My First Big Win on BITO

At the top of 2022, traders started to realize that the correction was turning into something more than a brief dip — we were entering a bear market.

(Of course, I warned everyone about the impending crash back in December 2021. Some listened, others sadly didn’t…)

While many were still panicking, trying to find long trading opportunities — I found myself in my element in January, with plenty of overextended stocks to potentially short.

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

And as the major indexes were just starting to crack, the crypto market was heading into a bearish tailspin.

With a bit of luck and good timing, it was around this time when I nailed my first juicy put trade on the ProShares Bitcoin Strategy ETF (NYSE: BITO).

Back then, Bitcoin (BTC) was trading for $45,000. Remember those days? Oh, how the mighty have fallen!

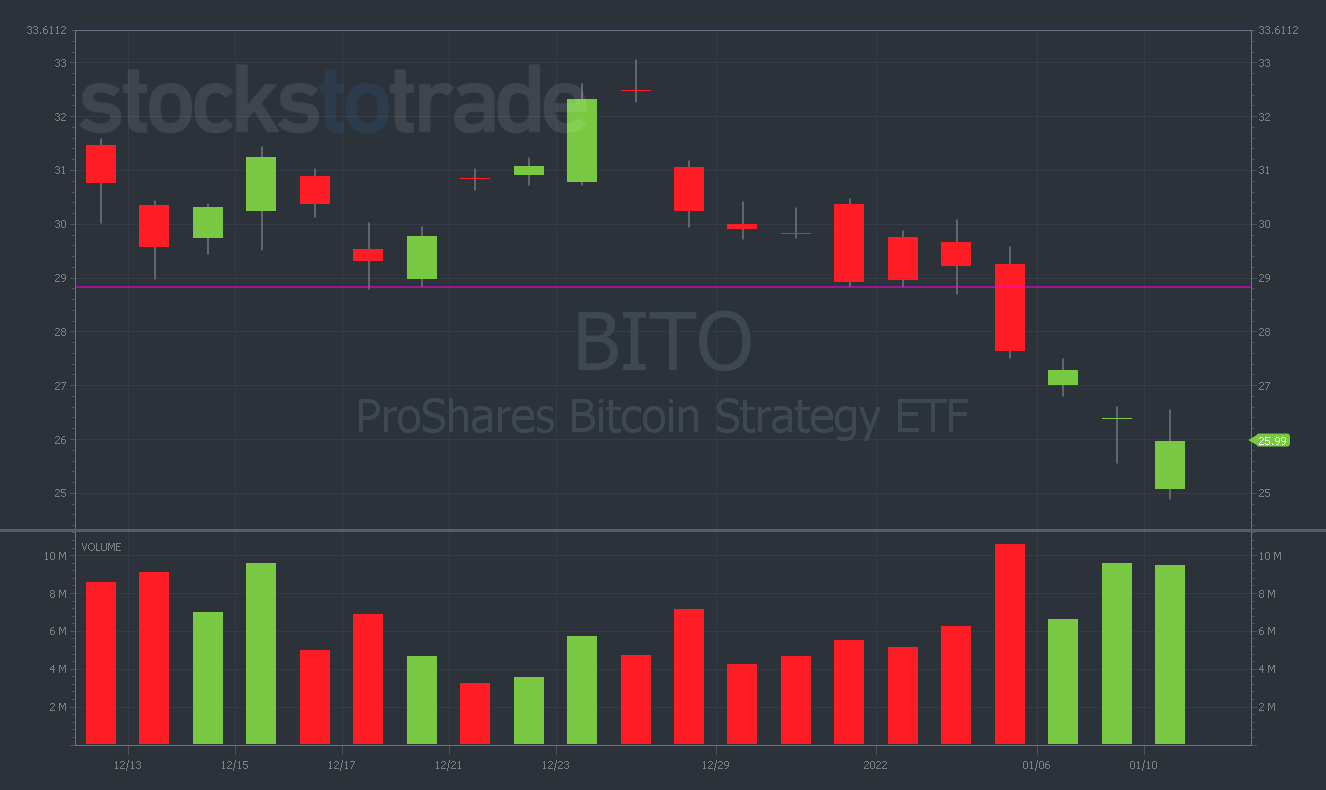

At that point, I was watching the $45,000 level for any signs of cracking. Then, as I was recording a video lesson on Wednesday, January 5 — the BTC chart started dipping toward $44,000. Take a look at the BITO chart (I’ve drawn a purple line at the key support level)…

BITO 1-month daily chart (from January 11) — courtesy of StocksToTrade

I was quick to pull the trigger at a critical moment. I bought BITO puts as a way of synthetically shorting BTC.

Sure enough, my swift conviction paid off. I ended up profiting around $40,000 on the trade, setting my year off to a fantastic start.

And I didn’t know it at the time, but in many ways, this trade foreshadowed the $230,000+ grand slam I hit on BITO last week — my biggest win of all time.

February: Attempting to Call the Bottom on FB

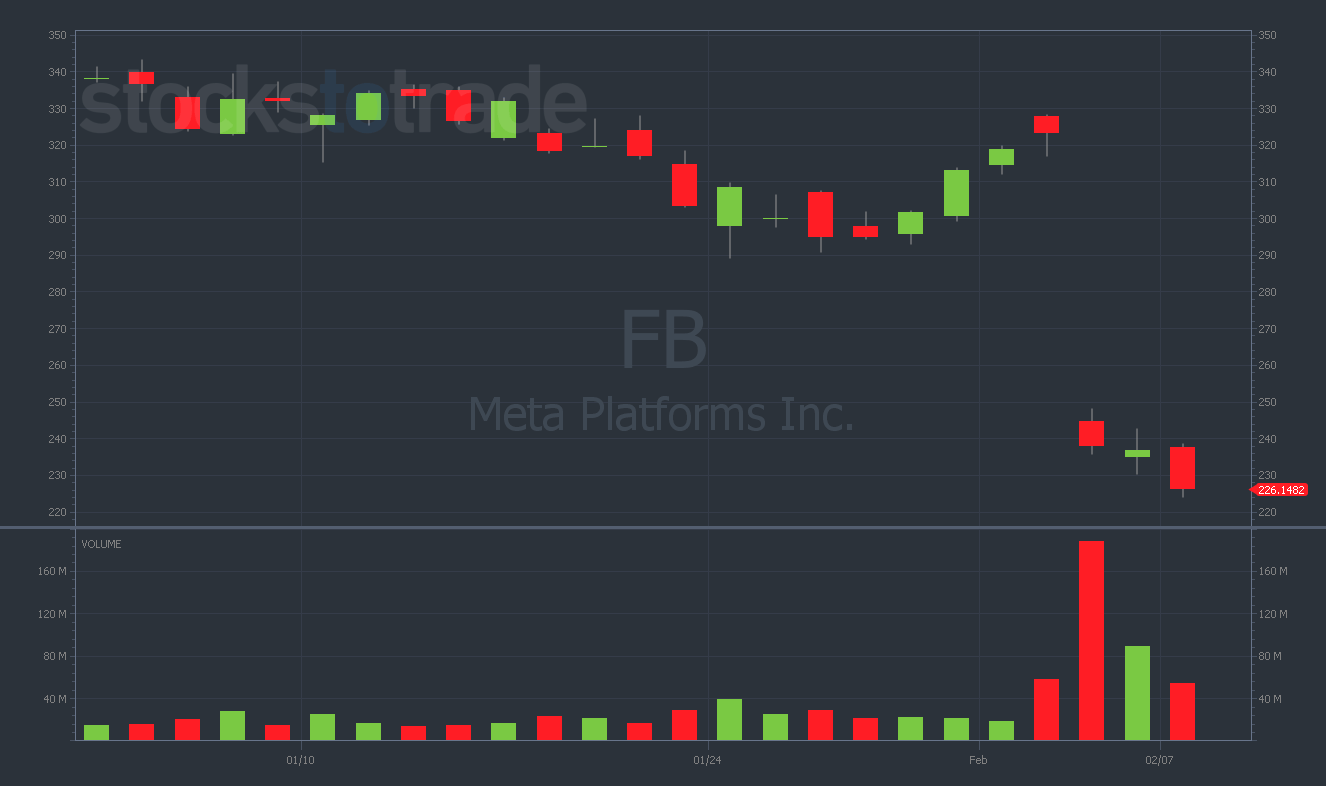

FB YTD Daily chart (from February 7) — courtesy of StocksToTrade.com

In early February, Meta Platforms, Inc. (NASDAQ: FB) reported terrible earnings and lost $250 billion in market value — the biggest single-day wipeout in the history of the stock market.

As most of you know, I prefer buying puts to calls. However, when one of the biggest companies on the planet lost 25% of its value in an afternoon — the temptation to bet on a bounce was simply too great.

In my mind, the odds of a bullish reversal — even a small one — were pretty good. So that Friday, I went ahead and bought FB 2/11/2022 $240 Calls.

But unfortunately, I was wrong. FB shares continued to get punished during Monday’s session, shedding another 5% of market value.

Obviously, my call options got destroyed. And I learned three valuable trading lessons in the process…

- Lesson #1: Don’t Go Long Before the First Green Day

I simply got into this trade way too early. I was attempting to call the bottom on FB before it formed.

In hindsight, I made the setup more difficult than it needed to be. I needed to be more patient.

Had I simply waited for the first green day before going long, I would’ve had the confirmation that a near-term bottom was in before risking money on the long side.

- Lesson #2: Stick to Your ‘Bread-and-Butter’ Strategy

As I mentioned earlier, my primary strategy is buying puts on over-hyped momentum stocks. Bullish setups aren’t my bread and butter.

I need to remind myself of this and stop trying to trade patterns that are outside of my area of expertise (unless they’re undeniable slam-dunks).

- Lesson #3: Resist the Urge to ‘Revenge Trade’

A less experienced trader might have been tempted to re-enter another FB call trade after this subpar play. But not me.

If you lose on a position, and then you stubbornly get into a similar position to try to make your money back — that’s called ‘revenge trading.’

Do you know this mystery man?

He’s just discovered one of the most powerful ways to take on this bear market as a trader…

All from exploiting one tiny niche of the stock market (only 4% of stocks) that can bring in 2x, 5x, even 10x BETTER returns than penny stocks.

And he just went live on camera to talk with the public for the first time.

The last thing I’ll do is try to revenge trade FB. The setup didn’t work … It’s time to move on to another. (I haven’t touched this stock since February.)

NOTE: On February 24, Russia invaded Ukraine, setting a still-ongoing conflict in motion and fundamentally changing the market backdrop.

March: Oil Stocks Tank (and I Make Some Mistakes)

I’ll be honest, March was somewhat of a disappointing trading month for me…

It got off to a promising enough start as I accurately predicted the near-term top in the energy sector.

That said, I didn’t capitalize on my vision as much as I would’ve liked. I failed to get aggressive at the right time and missed a huge part of the downside move in Chevron Corp. (NYSE: CVX).

It’s always irritating when you’re right about a move but don’t have an excellent trade to show for it. But that’s just how it goes sometimes.

Disappointingly, March only got worse as it went on. I ended up losing $20,000+ trying to short Occidental Petroleum Corp. (NYSE: OXY) right after Warren Buffett started buying it.

WARNING: Take it from me — don’t try to short stocks that Warren Buffett is buying!

I was still emotional from the CVX trade, which clouded my judgment as I entered the OXY play. I also sized too aggressively, risking more than I truly wanted to lose.

Even worse, I didn’t internalize this lesson during the OXY play. Just a few weeks later, I oversized again as I was buying puts on AMC Entertainment Holdings Inc. (NYSE: AMC) and lost another $60,000 in the process!

Learn the secret Tim used to turn a small investment into a fortune

This goes without saying, but risking more than you’re willing to lose is a critical error. I should’ve known better in both of these instances … and the price I paid was $80,000+!

WARNING: If you don’t manage your risk CAREFULLY, you won’t stay in the trading game very long.

Sometimes I look back on my trades and have no idea what I was thinking. But that’s exactly why I write these mid-year reviews. They’re as much for me as they are for you!

To Be Continued…

As you can see, 2022 has been quite the whirlwind year for me so far. And I’ve only made it through March so far…

We haven’t even touched on earnings season, my brand-new trading strategy, or my biggest trade of all time yet!

So make sure to tune in tomorrow for Part II of my mid-year review.