As a trader, it’s essential to recognize that market trends can be unpredictable, and what worked yesterday might not work tomorrow.

These shifts can catch traders off guard, leading to potential losses or missed opportunities.

Take it from me. I’ve been wrong about the direction of the market at certain points in 2023, which caused me to make some very regrettable trades.

But now, I’m embracing a new philosophy. I’m treating the trend as my friend.

The stock market is absolutely cooking right now … surging into red-hot, full-on, bull-market territory.

And I’m looking for slightly different trades than I normally do.

With that in mind, keep reading and I’ll show you how to potentially weaponize the trend to your advantage…

Adapting to Shifting Market Conditions

The market is cyclical. It goes through phases. There’s never one theme that works well all the time.

And realizing this is one of the biggest leaps forward you can take as a trader.

Let’s look at an example from recent history…

As the global pandemic pressed on throughout 2020 and 2021, the tech sector was hotter than ever.

It made sense. With in-person abilities limited, more people used tech than ever before. That’s why the Nasdaq, which is full of tech stocks, was surging for two years straight!

Throughout this period, my main trading strategy was carefully shorting overcrowded momentum stocks.

It worked because so many names were flying high, leading to inevitable dumps. Plus, my negative bias naturally leads me toward bearish put trades.

But if you prefer long trades, you could’ve employed a different strategy, scalping or swinging tech calls throughout the entire pandemic bull run.

Now, imagine you’d been using that strategy, and then January 2022 rolled around…

Suddenly, it was impossible to make money playing tech calls. As the Fed began hiking interest rates, every long position in tech started getting destroyed.

If you didn’t switch setups … you were doomed.

This is what the market does. It constantly morphs from one phase to another, trying to trick traders into making incorrect decisions.

And right now, as we dive headfirst into the second half of 2023, I’m seeing a comparable (yet different) paradigm shift as the market sizzles into further strength…

Don’t Fight the Trend

During the first few months of the year, I was leaning bearish.

I wrote about how I believed stocks were in a bear market rally. And I wasn’t alone.

A wide variety of pundits, analysts, traders, and investors were positioned for a major correction (or recession), even after 2022’s brutal stock market rout.

But we were all wrong. And I have no problem admitting that.

In fact, understanding that your predictions are off-base and having the discipline to switch gears is one of the greatest strengths a trader can possess.

You can’t be a perma-bull or perma-bear. You must be willing to adapt to shifting market conditions.

That’s exactly what I’ve been focusing on recently. After a rough string of losing trades, I realized that I needed to completely flip my mindset.

I was trying to fight the trend when I should’ve been seeing the trend as my friend. So, I began looking at potential call plays…

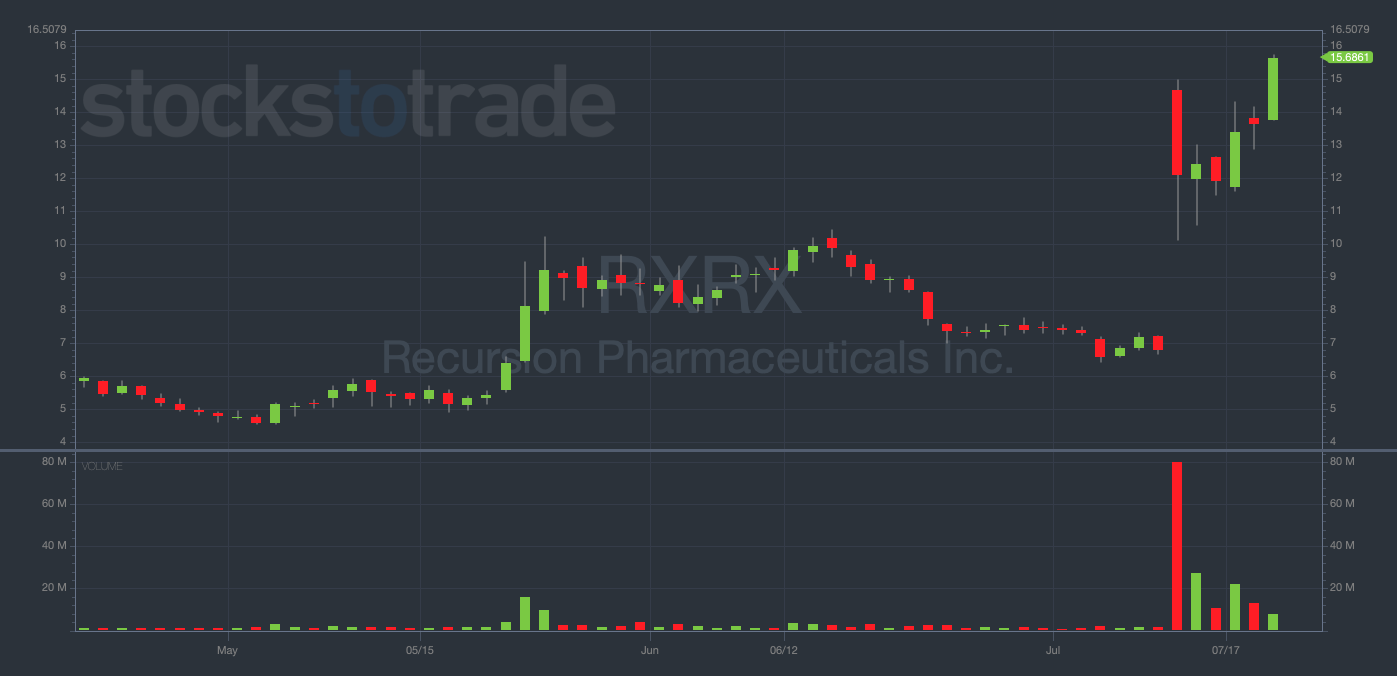

I called out Recursion Pharmaceuticals Inc. (NASDAQ: RXRX) on Monday at $11.71, which is trading for $16.09 at the time of writing. The stock was up a whopping 17%+ yesterday, posing a fantastic trading opportunity to anyone who heeded my advice…

RXRX 3-month daily chart — courtesy of StocksToTrade.com

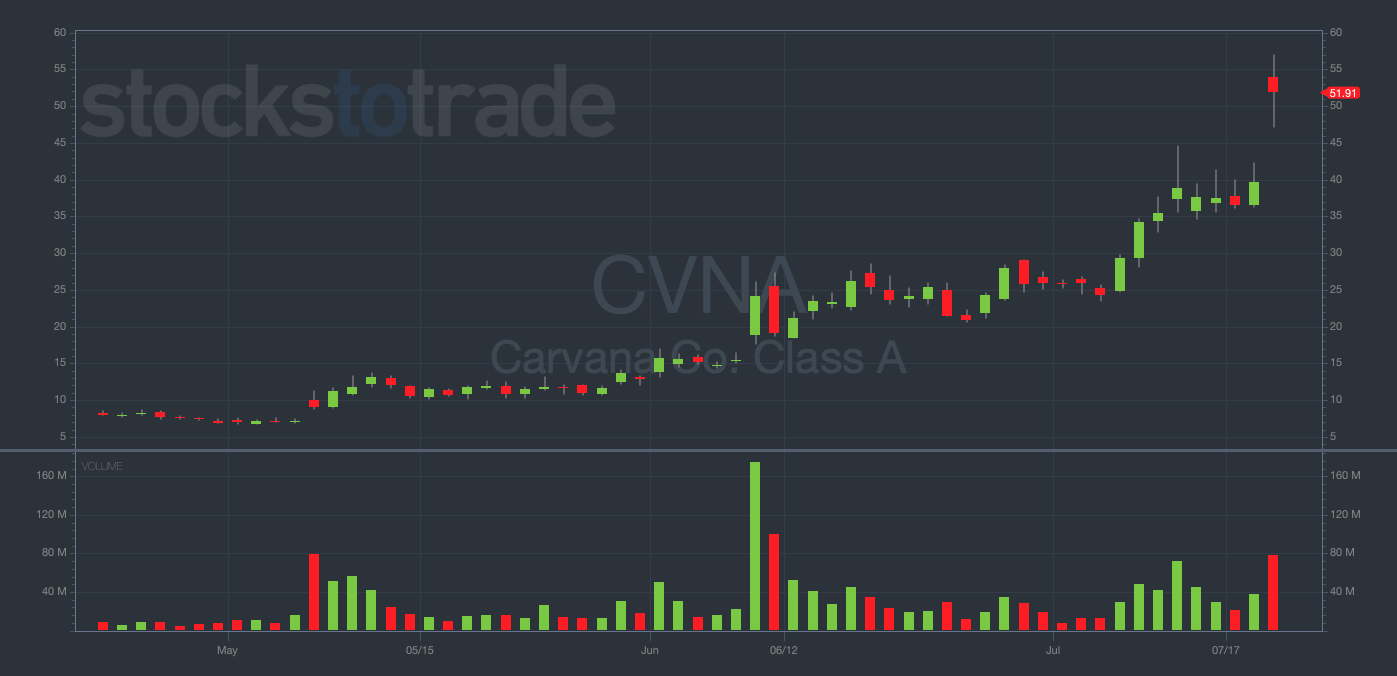

Additionally, I’ve been keeping my eyes on Carvana Inc. (NYSE: CVNA), one of the craziest short squeeze plays since Bed Bath & Beyond Inc. (OTCMKTS: BBBYQ) went parabolic last year…

CVNA 3-month daily chart — courtesy of StocksToTrade.com

SPOILER ALERT: I made a pretty lucky CVNA calls trade on Tuesday (but more on that later this week)…

Note that BBBY was on the verge of bankruptcy when it started violently squeezing upward in 2022. The ticker has since been removed from the Nasdaq and relegated to the OTC markets.

Does a similar fate await CVNA? Well, probably. I certainly expect this stock to get destroyed soon.

Short squeezes don’t last forever and I don’t think anyone is buying and holding this struggling company for the long term.

That said, don’t try to be a hero. CVNA was up nearly 40% on Wednesday. Don’t just buy puts on this stock out of nowhere. Wait for the overall market trend to turn.

This is really what I’m getting at…

Again, the trend is your friend. When the market is this hot, go with the flow and look for call-trading opportunities.

This doesn’t mean it’s impossible to find good short opportunities in this market, but it’s definitely more difficult.

And I don’t see a good reason to make trading any more challenging than it already is!

Final Thoughts

Don’t fight the trend, Evolvers!

Pay close attention to the shifting tides of the markets.

And don’t let the currents take you too far away from the shore.