When you’re trading the stock market, emotions can often run high.

The thrill of making profitable trades and the disappointment of losses can create a rollercoaster of feelings.

And one emotion that can be particularly dangerous for traders is the urge to seek revenge after a loss.

Revenge trading — driven by anger, frustration, or desperation — is a common (but harmful) behavior that can have dire consequences for both newbies and experienced traders alike.

But, fortunately, there’s a light at the end of the tunnel for traders caught in the revenge trading trap.

By acknowledging the issue, understanding the underlying causes, and implementing practical strategies … you can potentially break free from this self-destructive pattern and regain control of your trading journey.

Keep reading and I’ll show you…

The Problem with Revenge Trading

Revenge trading refers to the act of engaging in impulsive and high-risk trades immediately after experiencing a loss.

Instead of carefully analyzing market conditions and making well-informed decisions, revenge traders allow their emotions to dictate their actions.

They’re driven by a desire to recoup their losses quickly, often without a solid strategy or proper risk management in place.

One of the primary reasons revenge trading is so problematic is that it goes against the fundamental principles of successful trading.

Trading should be approached with a calm and rational mindset, backed by diligent research and analysis.

However, revenge trading throws all caution to the wind, leading to impulsive and reckless decisions…

The Importance of Addressing the Issue

Revenge trading can have severe consequences on a trader’s financial well-being, mental health, and overall trading career.

By succumbing to the temptation of revenge, traders often find themselves caught in a vicious cycle of losses, with each impulsive trade further exacerbating their downswing.

Moreover, the emotional toll of revenge trading can lead to stress, anxiety, and a negative mindset, hindering one’s ability to make sound trading decisions in the future.

I’ve learned about revenge trading the hard way…

I’m usually pretty good about keeping my emotions in check, but my human urges take over occasionally…

For example, in March of last year, I took a $60,000 single-day loss by revenge-trading puts on AMC Entertainment Holdings Inc. (NYSE: AMC)…

Took six fig loss on $TSLA and $AMC very much deserved, but I'll bounce back stronger!! Gotta respect this bear market bounce/melt-up/Q1-"paint taping"

— Mark Croock (@thehonestcroock) March 30, 2022

I only put this trade on because my emotions were running high from a previous big loss on Tesla Inc. (NASDAQ: TSLA)…

Bottom Line: I was trying to make up for my TSLA losses by rushing into AMC puts with poor timing. This is the definition of revenge trading and I’ve learned my lesson!

Remember that stocks don’t owe you anything.

If you try to revenge trade a ticker (or setup) that isn’t working for you, you’re fighting an uphill battle. And setting yourself up for FAILURE.

5 Simple Ways to Overcome Revenge Trading

If you ever find yourself spiraling into a vicious cycle of revenge trading, consider taking one (or all) of the following five steps…

Embrace Emotional Discipline

Recognize that trading is inherently filled with both wins and losses. It’s essential to cultivate emotional discipline and detach yourself from each individual trade’s outcome. Don’t be too results-oriented. Accept that losses are a part of the game and focus on the bigger picture.

Analyze and Learn from Mistakes

Instead of seeking revenge, use each loss as an opportunity for growth and learning. Analyze the factors that led to the loss, identify any mistakes made, and take them as valuable lessons for future trades.

Maintaining a trading journal can help you track and reflect on these experiences.

Stick to Your Game Plan

A well-defined trading game plan is a trader’s best defense against revenge trading. Set clear entry and exit points, establish risk-reward ratios, and follow a systematic approach.

Having a plan in place helps traders avoid impulsive decisions driven by emotions. If you truly stick to your game plan, revenge trading should be impossible.

Are you familiar with this trading “loophole?”

Are you familiar with the “loophole” that helps small accounts grow exponentially?

No, it doesn’t have anything to do with penny stocks or crypto…

And this strategy works regardless of whether the markets are up OR down…

This little-known options “loophole” is something you can use to grow your trading account right now…

Implement Proper Risk Management

Effective risk management is crucial to mitigate the impact of potential losses. Set stop-loss orders to limit potential downside, never risk more than a predetermined percentage of your trading capital on a single trade, and don’t go all-in on single-day YOLO call options!

Seek Support and Accountability

As an Evolver, you’re already way ahead of the vast majority of traders who wander the waters of the stock market alone, without any help or guidance…

Not only am I here to help you learn and grow beyond revenge trading, but so are your fellow Evolvers…

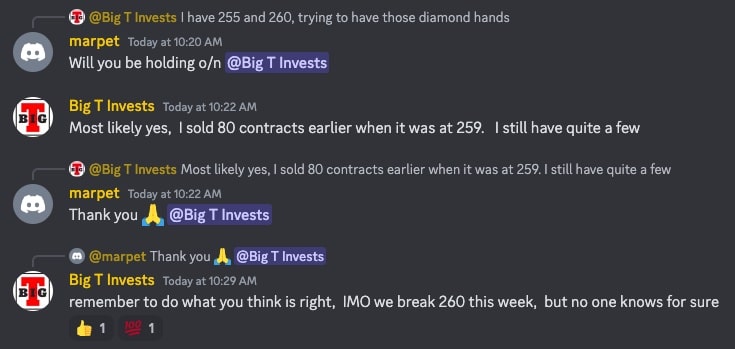

You’ve surrounded yourself with an amazing community of like-minded individuals who understand the challenges of trading. Get in my Discord channel and start sharing ideas. Embrace the idea of team trading.

Your peers can offer valuable support during difficult times. Look at this conversation that occurred in my Discord this morning regarding TSLA calls…

Final Thoughts

Revenge trading is a dangerous pitfall that can derail even the most promising trading careers.

Succumbing to emotions and seeking revenge after a loss only perpetuates a cycle of self-destruction.

So, whatever you do, remember this…

To succeed in the stock market and avoid revenge trading … you must prioritize emotional discipline!

Learn from your mistakes, implement a well-defined trading plan with proper risk management strategies, and stop revenge trading for good!