It’s always nice to bounce back with a solid trade after a disappointing loss…

Here’s some context…

Last week, I failed to fully capitalize on the inevitable downside following the blow-off top of the Bed Bath & Beyond Inc. (NASDAQ: BBBY) short squeeze.

Instead of being patient and sticking with the $20 weekly puts I had originally purchased, I let intraday price action scare me out of a winning setup…

Had I held those puts for another day or so, I would’ve made a massive profit. Instead, I sold for a $20,000 loss.

But I’m an experienced trader. I don’t let losses affect my game plan.

As disappointed as I was in the BBBY trade, I knew that I’d have the opportunity to redeem myself soon enough.

After all, trade opportunities are like buses … there’s always another one coming.

Sure enough, last Friday, August 19, I was convinced the major indexes were forming a near-term top, so I bought puts on Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), and The Walt Disney Co. (NYSE: DIS).

Keep reading to see how my trade panned out…

The SPY’s First Red Week

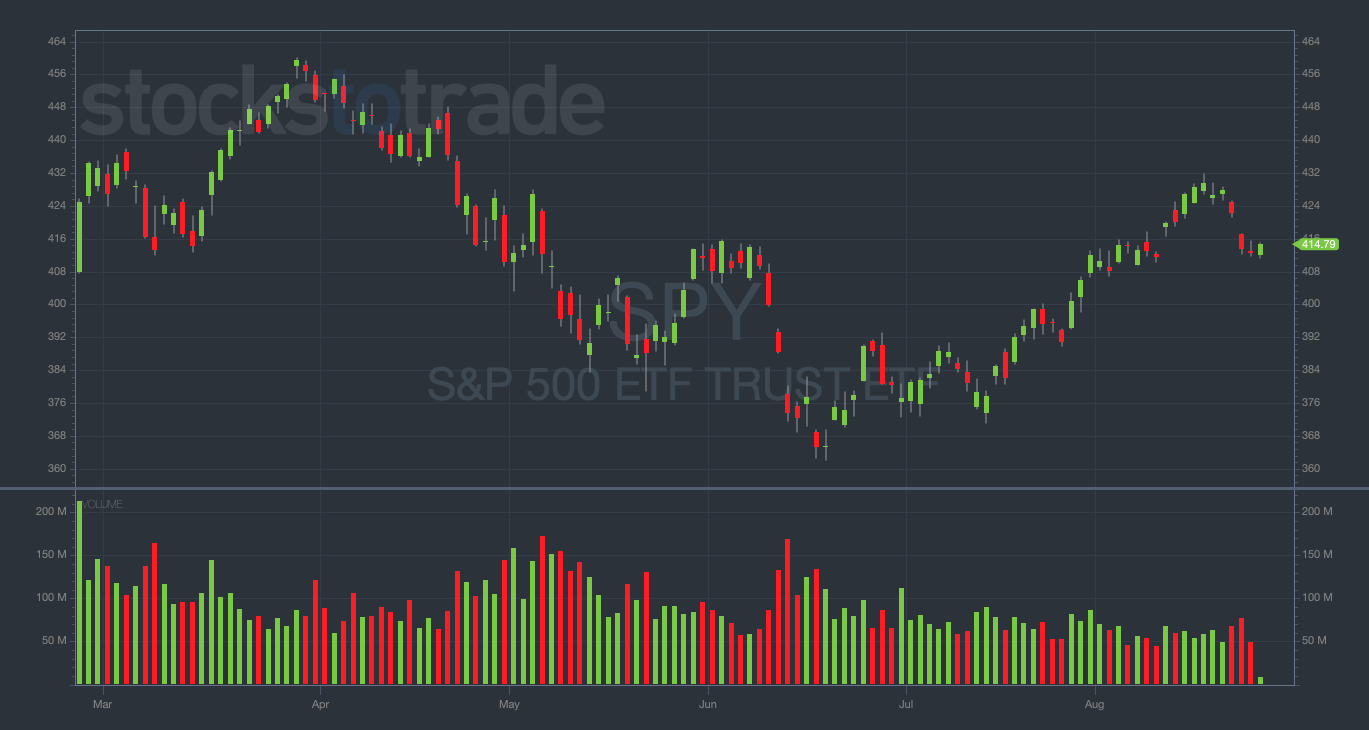

As last week’s price action was heading into a close, I was paying close attention to the S&P 500 ETF Trust (NYSEARCA: SPY)…

SPY 6-month daily chart — courtesy of StocksToTrade.com

Why was I watching the SPY like a hawk?

Because the index was finally putting in its first red week…

Anyone who’s followed my trades for a while will know I relish the first red week/first red day for put-trading opportunities.

After all, the first red week/first red day is my favorite pattern I’ve ever learned from Tim Sykes. I’ve used it over and over again to help me reach nearly $4 million in trading profits.

These periods can bring about HUGE selling, which can mean even bigger profits for put traders.

Let’s take a short trip down memory lane…

Back in late June, I pointed out the first red week on Exxon Mobil Inc. (NYSE: XOM) and how it was presenting a potential slam-dunk short opportunity.

Can you guess what happened next? Just one week later, we saw the complete destruction of oil stocks.

Bottom line: This wasn’t a coincidence. The first red week very often capitulates into further selling.

Knowing my history about the first red week led me to the play we’re gonna discuss today…

How I Nailed My Three-Legged Puts Trade

So, I knew I wanted to short the overall markets … but how?

If you know me, you know I almost exclusively trade options. And I knew this setup wouldn’t be any different in that regard.

If you want to see how I developed from a 9-to-5 accountant into a multi-millionaire options trader, then click here to download my brand new ebook FOR FREE!

$127k in just 24 hours?! 😳

Did you catch the Shadow Trades Summit with Tim Sykes and Mark Croock?

If not, check it out now before it’s too late.

Mark pulled back the curtain on his shadow trades strategy…

Detailing step by step how he was able to make $127,000 in just 24 hours, during the middle of a market crash!

Instead of simply buying puts on the SPY, I decided to spread my trade out a bit and buy a combination of bearish contracts on names that are heavily weighted in the SPY (and other major indexes).

After looking at my options (excuse the pun), I decided to buy the following contracts:

Apple Inc. (NASDAQ: AAPL) 8/26/2022 $170 Puts for $1.30 (sold for $2.61, +99%)

Amazon.com, Inc. (NASDAQ: AMZN) 8/26/2022 $135 Puts for $0.89 (sold for $2.40, +168%)

The Walt Disney Co. (NYSE: DIS) 8/26/2022 $115 Puts for $0.34 (sold for $0.84, +146%)

All told, between the three positions I entered with a starting stake of just over $75,000 on Friday.

By Monday, I had more than doubled my principal for an overall gain of 113% and a verified profit of $85,062!

After so many weeks of a bear market rally, I knew the dip was coming.

All I needed was the first red week for confirmation. And this time, unlike last week with BBBY, I was able to capitalize beautifully.

Final Thoughts

I don’t write this to brag or show off my gains.

Rather, I’m detailing my trade thesis to show you my thought process behind a classic first red week trade.

These setups are my bread and butter. Back to the basics. It doesn’t get much more perfect for my strategy than this.

I want you to start to see the first red week for what it is … a golden opportunity for trading puts.