Listen up, Evolvers…

With a new week upon us, this needs your attention…

The major indexes are starting to look very toppy. I think it’s time to start considering getting bearish.

And I’m not the only one who thinks this…

This is SUCH an ugly $DIA $SPY $QQQ market right now, the saying "sell in May and go away" likely applies as we're just over-extended and due for a pullback. The question is how much of a pullback as we still have tons of newbie gamblers with no risk management who need lessons

— Timothy Sykes (@timothysykes) May 12, 2023

That said, if you don’t design your bearish positions carefully, you could miss out on a potentially account-changing puts trade. Or worse, you could take an avoidable loss.

So, keep reading and I’ll explain how I trade ugly markets, like this one…

Why I’m Getting Bearish

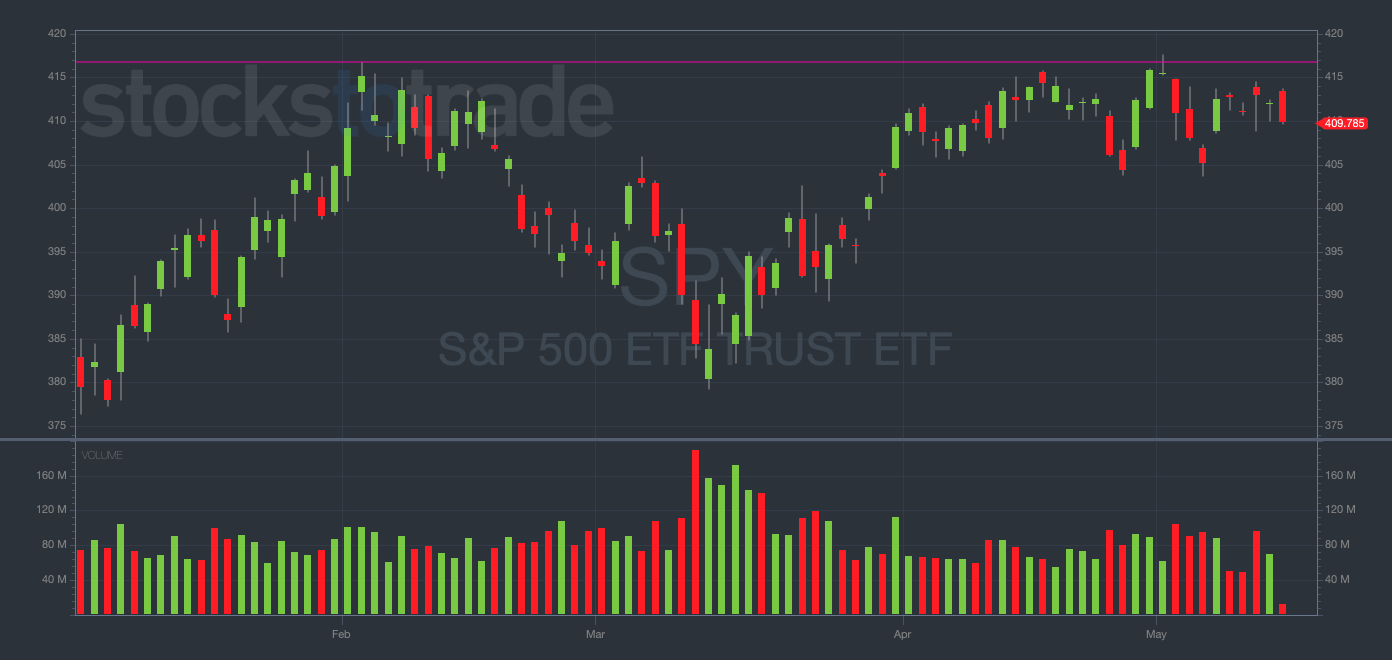

The major indexes are starting to display some serious topping signals. Look at this chart for the SPDR S&P 500 ETF Trust (NYSEARCA: SPY)…

SPY YTD daily chart — courtesy of StocksToTrade.com

I’ve drawn a purple line on the chart’s major resistance level at $416. But you shouldn’t need the line to see this…

The SPY has failed to make a daily close above the $416 level every time it’s attempted to do so in 2023.

Now, as the chart hovers near this level for a third time this year, I’m betting that the SPY will get rejected once again.

Look at the downside to the lows of the chart vs. the upside to the highs. It’s hard to ignore which direction has a better risk/reward at these levels…

Spoiler Alert: It’s the downside!

Additionally, the bullish price action in the Invesco DB U.S. Dollar Index Bullish Fund (NYSEARCA: UUP) — which trades inversely to the major indexes — leads me to believe the stock market is potentially overdue for some near-term downside.

To hear the full details of my thoughts on the U.S. dollar and how it’s affecting the markets, read last Friday’s Q&A by clicking right here.

But for now, let’s dive deep into how you can trade the upcoming market reversal I’m expecting…

Put Options > Shorting Common Shares

My mentor Tim Sykes has been warning traders about the risks of shorting stocks for years. And he’s right to do so.

I agree with Sykes. Shorting common shares is just too risky…

In fact, the risk is infinite, because stocks have no limit on how high they can go (theoretically).

Remember the historic GameStop Corp. (NYSE: GME) gamma squeeze of January 2021?

Make no mistake … the only reason that stock ever traded to $500+ was because of this exact concept.

That’s why I love trading options, specifically put contracts — because I’m able to define my risk.

By trading puts, I’ll never lose more than my principal investment in the position. I can sleep like a baby holding puts (as long as my kids don’t wake me up in the middle of the night)!

Don’t ignore this…

I think some traders, especially those newer to options, are under the false impression that buying puts is inherently riskier than buying calls.

But that’s not accurate…

Puts are the simplest way to bet against a stock without risking a margin call or blowing up your entire account.

And I want every Evolver to get that, loud and clear.

Stairs Up … Elevator Down!

I’ve said it before and I’ll say it again … stocks take the stairs up and the elevator down!

Just pull up the daily chart for any crazy momentum stock to see a picture-perfect illustration of this concept. Here’s an ideal example from this year…

AI YTD daily chart — courtesy of StocksToTrade.com

See how long it took for AI to climb from $20 to $34? Two months…

Now, how long did it take for the stock to erase those gains? Only two days!

If you had focused on your timing and bought put contracts near the top at the beginning of April, you potentially could’ve made a small fortune in 48 hours.

And these are exactly the kinds of massive breakdowns I look to take advantage of.

Consider this…

If you had shorted the shares instead of trading puts, you would’ve had a maximum gain of just over 52%

But with puts, the pricing relationship is completely different. Put contracts can 10-20x in a huge crash while a common-share short is stuck tracking the borrowed stock to the cent.

This seems too good to be true, yet it is…

I don’t know of many other strategies that can consistently deliver such massive returns. That’s why I trade the way I do and why I’m pointing you toward these setups in the current market environment.

Final Thoughts

This market is starting to look ugly, Evolvers…

But that’s not a bad thing for traders, like you and me…

As long-term investors are stuck holding the bag, we can focus on put-trading opportunities to potentially capitalize on the downside.