Every six months, I like to take a step back and review all of my trades from that period.

I’ve said it before and I’ll say it again … self-reflection is critical for traders.

If you don’t examine your trading, you’ll never know which strengths you should lean into or what weaknesses you can improve upon.

I find that these mid-year reviews not only help you understand my trading mindset but also help me to form a comprehensive view of my performance.

The bottom line: I’m always looking for ways to improve my trading … even if it’s by a small fraction.

And it’s been a historically bad first half of the year in the markets — the worst start for the S&P 500 since the Nixon era.

My 2022 trading, however, has been more of a mixed bag. I’m incredibly proud of some of my plays — and downright disappointed in others.

Yesterday, we covered the first three months of the year. Now it’s time to bring you all up to the present.

Keep reading and I’ll walk you through the second half of my mid-year review…

April: Elon vs. Twitter Dominates the Headlines (and I Nail a Bold Prediction)

April was a relatively uneventful trading month for me, but there was one significant development (more on that in a bit)…

The month started dominated by one news story — Elon Musk’s proposed purchase of Twitter Inc. (NASDAQ: TWTR).

Are You Missing Out On Epic Trades?

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

Tim Sykes encourages his students to use Breaking News Chat every day:

I debated how I could potentially ‘trade the news’ on TWTR but ultimately decided against speculating around such an unpredictable play.

The TWTR trade trapped a lot of newbies with FOMO. Don’t fall for these sucker plays, it’s usually very difficult to extract gains from these types of trades if you’re not in very early.

Throughout the second half of April, I was embarking on a new adventure — my $3,000 Small-Account Challenge!

That said, this isn’t my first small-account challenge…

Last year, I took a small account with a $10,000 starting balance and turned it into $130,000+ in just a few weeks!

(Naturally, I’m trying to re-create those returns in my new challenge. It’s going well so far, but the gains aren’t as quick as they were last time due to the overall market conditions, higher options prices, etc.)

Then, at the beginning of the third week in April, I made a bold prediction — that the bear market wasn’t over and the major indexes were headed lower.

The morning I published that letter, the S&P 500 ETF Trust (NYSEARCA: SPY) opened at $448.58.

And once again, I was right…

SPY immediately dumped more than 5% in the following two trading days. After that, the index shed another 15% — hitting a low of $362.17 just two weeks ago.

That’s a 20% drop in two months, right after I said this would happen! Just imagine the gains you could’ve made had you simply bought puts on SPY when I made this prediction…

May: Earnings Season Hits the Markets (and I Hit a Few Singles)

In May, I mostly sat on the sidelines and patiently waited for a perfect setup (that would eventually come in June).

Do you know this mystery man?

He’s just discovered one of the most powerful ways to take on this bear market as a trader…

All from exploiting one tiny niche of the stock market (only 4% of stocks) that can bring in 2x, 5x, even 10x BETTER returns than penny stocks.

And he just went live on camera to talk with the public for the first time.

Earnings season hit the markets, which is always a double-edged sword for options traders. In other words, there are pros and cons to this time of the year…

The pros are that earnings season tends to bring more liquidity and high-volatility trading opportunities to the options market.

The cons are that with the high volatility comes extremely elevated implied volatility (IV), which in turn makes options contracts more expensive, skewing the risk/reward out of our favor.

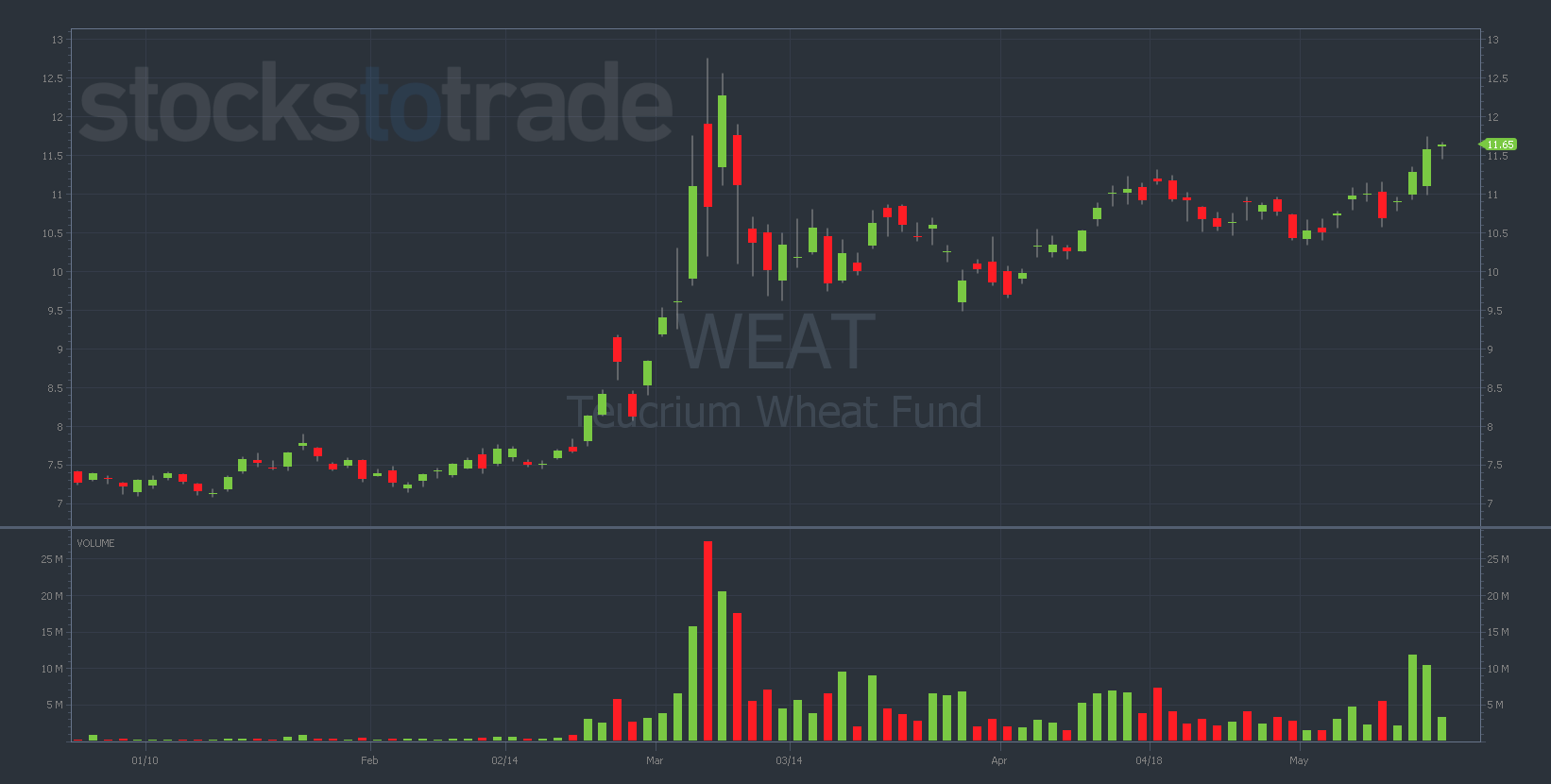

Later in May, I executed my first trade for the new small account by buying 6/17/2022 $11 calls on the Teucrium Wheat Fund (NYSEARCA: WEAT). Take a look at the chart…

WEAT YTD daily chart (from May 16) — courtesy of StocksToTrade.com

Why did I buy calls on an exotic commodities index I’ve never traded before? Because the Russia-Ukraine conflict caused a massive supply shortage of wheat and grain. And this is a news-driven market.

I had a modest win on this play but it was nothing to write home about. The following week, I hit another 43% single trading Walmart Inc. (NYSE: WMT) calls — turning $1,740 into $2,500 for a profit of $760.

Keep in mind that these trades were just initial building blocks for the small account. They were leading towards something much bigger in June…

June: I Reveal My ‘Shadow Trades’ Strategy (and Make My Biggest Trade of All Time)

Is it a coincidence that right after I finally revealed the top-secret strategy I’ve been developing for over a decade, I nailed my biggest trade of all time?!

I don’t think so, but I’ll let you be the judge…

At the start of June, I was feverishly preparing for the upcoming Shadow Trades Summit, where Tim Sykes and I unveiled my new strategy to the world. (You can still watch the replay right here.)

The main reason I’m so excited about Shadow Trades is that they work in any market conditions — even the brutal environment traders have been dealing with throughout 2022.

Plus, the fact that these setups are INVISIBLE to 99.9% of traders gives me and my students an almost ‘unfair advantage.’

And this exact edge led me to discover a five-star setup just a few weeks ago…

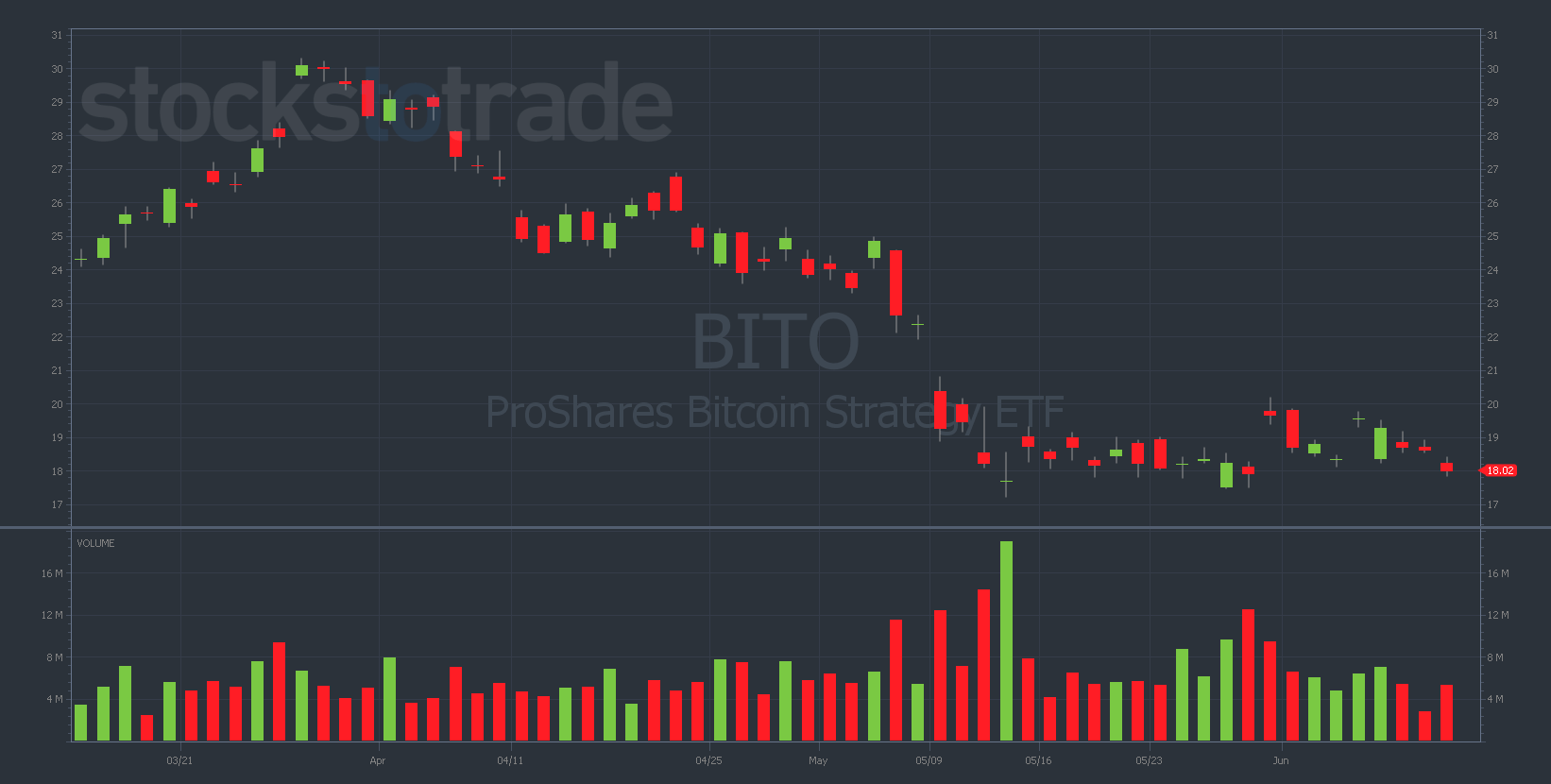

As the crypto markets were heading into a freefall and Bitcoin (BTC) lost key support at $30,000 … I bought ProShares Bitcoin Strategy ETF (NYSEARCA: BITO) 6/17/2022 $17 Puts for $0.47 and sold them for $2.50 — a gain of 530%! I turned less than $50,000 into $280,000+ in the process.

BITO 3-month daily chart (from June 13) — courtesy of StocksToTrade.com

My grand slam on BITO was an example of three critical trading lessons we’ve covered before:

- Identifying key price levels

- Picking the right strike prices

- Using options to leverage your gains on crypto stocks

I’m obviously over the moon about this trade and hope to nail many more like it in the future. We’ll have to wait and see what July holds in store for me…

Final Thoughts

All in all, I’d say my trading in the first half of 2022 was a mixed bag.

Did I nail my biggest win of all time? Yes.

But I squandered a few fantastic opportunities before that and lost money on others by oversizing on speculative trades.

I’m a perfectionist. Even as I’m nearing $4 million in career trading profits, I’m looking for ways to improve my strategy.

In the markets, I’m insatiably hungry for more. And I want to encourage every Evolver reading this to be the same way.